Overview

Enhanced Points positions itself as an “outreach layer” built specifically for asset managers and investor-relations teams. The platform aims to sit alongside existing CRMs and investor‑relations workflows to streamline multi‑channel investor outreach, automate distribution of investor materials, and accelerate fundraising and business development activity. Core value propositions (inferred from page titles and snippets) include centralized contact enrichment and segmentation, templated and personalized messaging at scale, governed sequencing across email/phone/social/events, and analytics to measure engagement (opens, responses, meetings, pipeline progress). Integrations with CRM systems are emphasized so teams maintain a single source of truth while offloading repetitive outreach tasks to a governed layer that preserves compliance and auditability. Typical use cases would include fund launches and capital‑raising campaigns, periodic investor updates, distributor and consultant outreach, and event invitations. The platform is framed for regulated environments: governance, approval workflows, and audit trails are likely highlighted to ensure communications meet compliance requirements. By reducing manual outreach and improving targeting, Enhanced Points claims to shorten lead‑to‑meeting cycles and increase conversion rates for asset managers. The site includes standard product pages (features, pricing) and legal pages (terms, privacy); however, the pricing page did not expose public plan details in automated extraction, suggesting pricing is likely available on request via demo or sales engagement.

Key Features

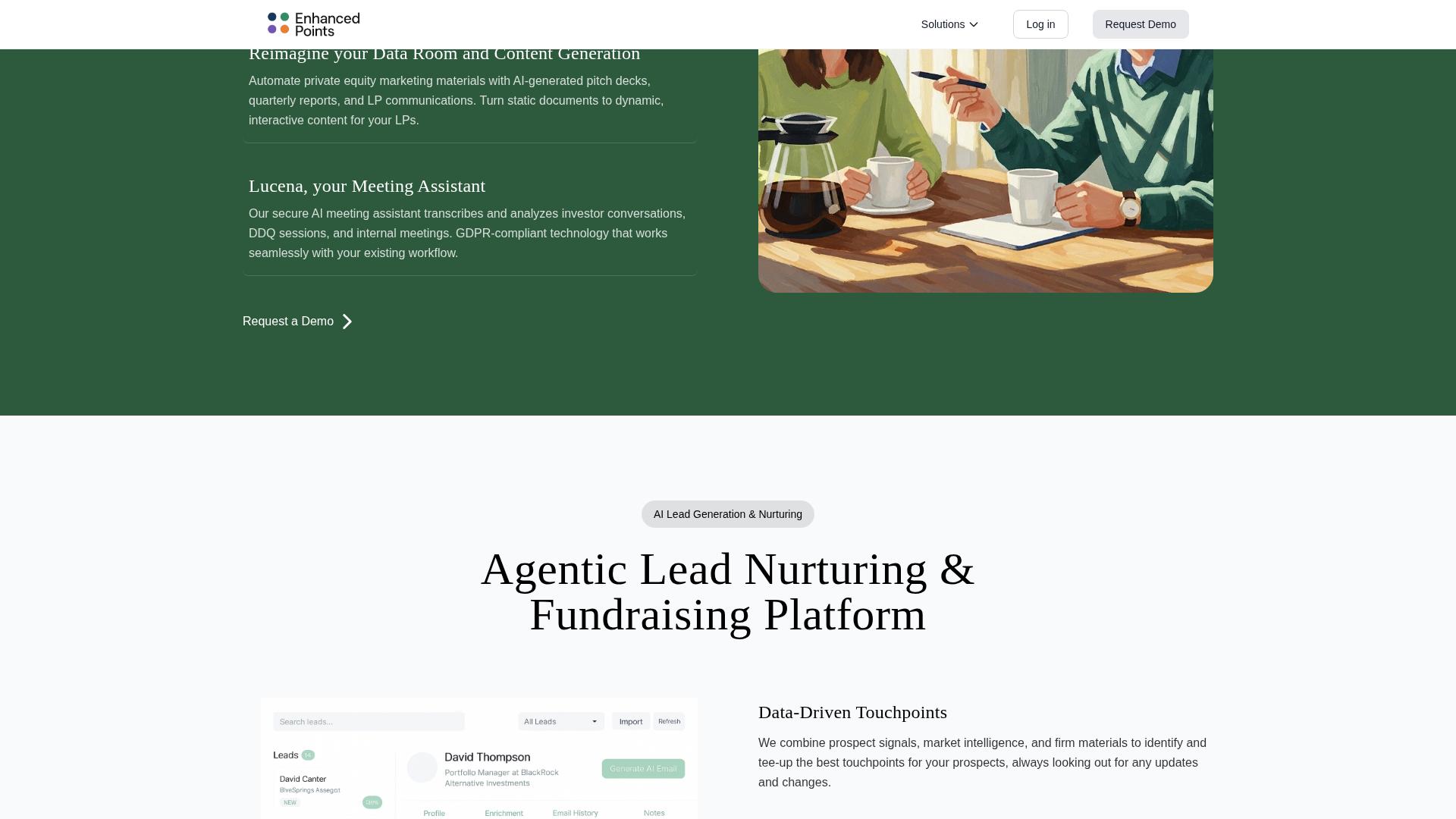

Centralized outreach layer

A centralized layer that complements existing CRMs and consolidates outreach tasks.

Contact enrichment and segmentation

Enhanced contacts with segmentation to target segments effectively.

Multi-channel sequences

Automated sequences across email, phone, social, and events.

Templated, personalized communications

Scale personalized messages with templates.

Compliance / approval workflows

Governance, approvals, and audit trails to meet regulatory requirements.

Analytics and dashboards

Engagement and pipeline metrics to guide outreach strategy.

Who Can Use This Tool?

- asset managers:Outreach to investors, multi-channel engagement, fundraising and investor communications

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

Pros will be listed here once they are curated.

✗ Cons

Cons will be listed here once they are curated.

Related Articles (3)

A measured-outreach layer for asset managers that delivers data-driven engagement and measurable results.

Veronica Vignoni highlights Fahad H.'s AI automation startup launch and shares her own ongoing professional-growth themes.