Overview

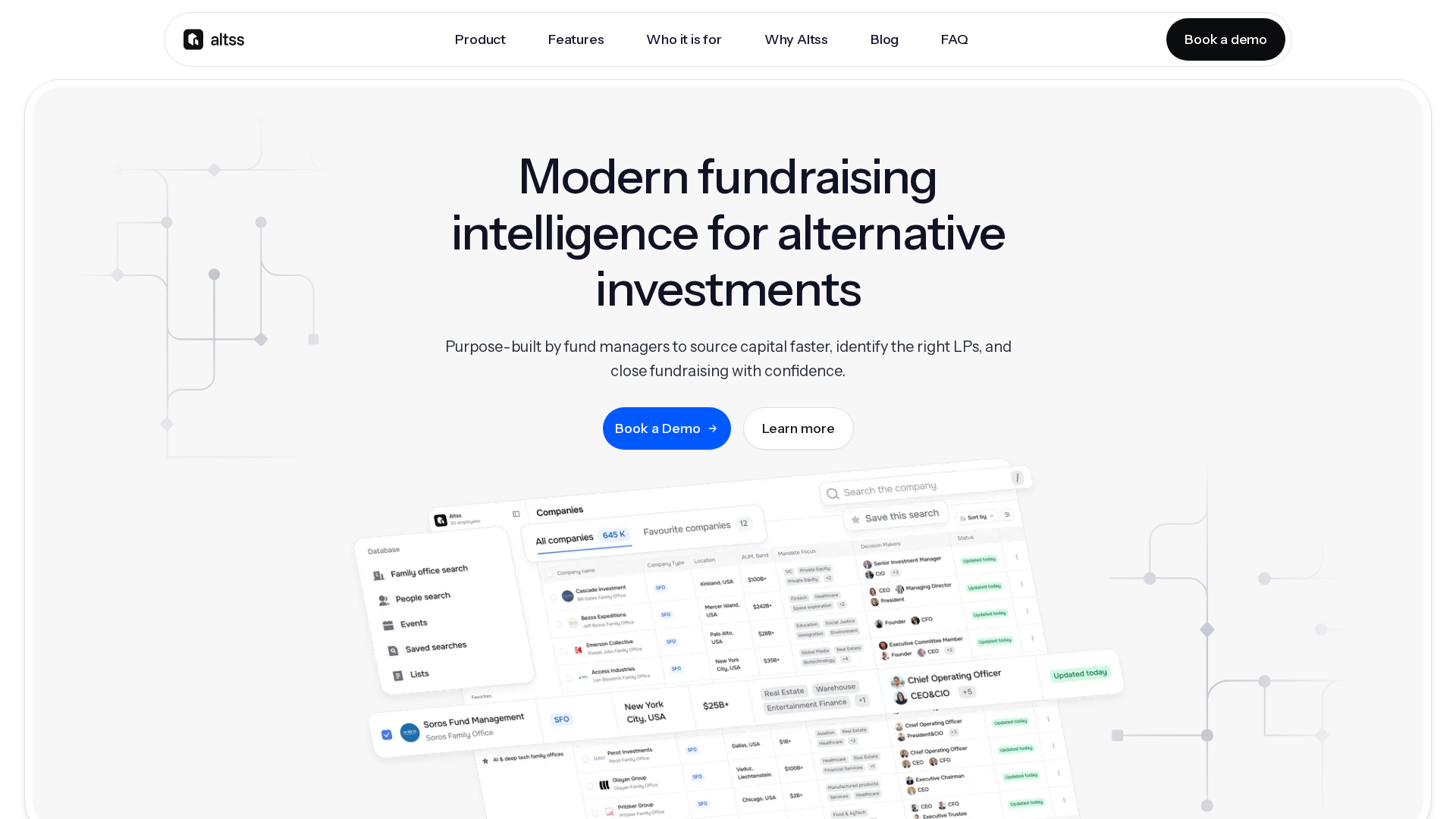

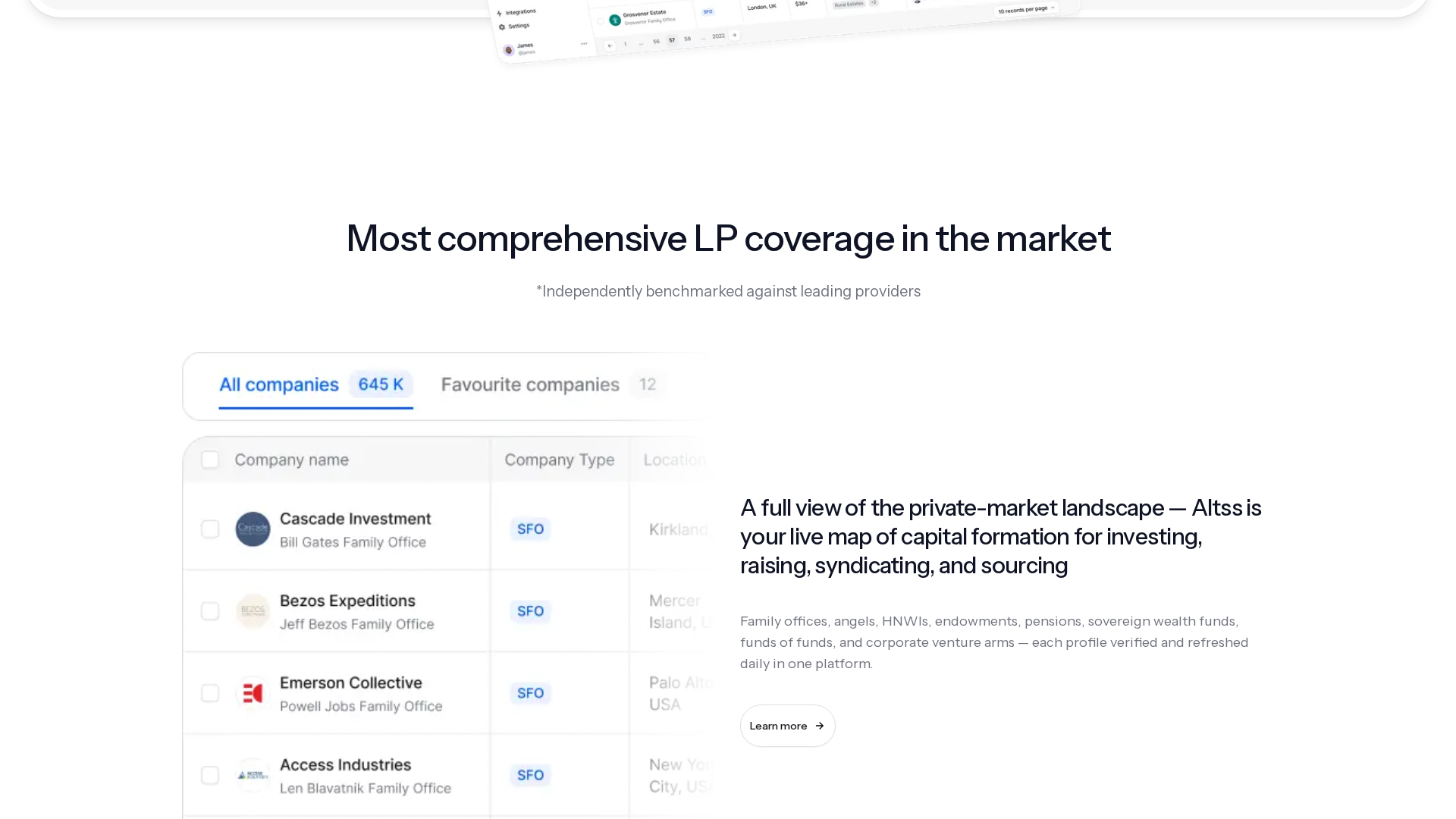

Altss positions itself as an OSINT-powered, real-time intelligence engine designed to speed fundraising, LP discovery, and deal sourcing in private markets. The platform emphasizes continuous signals from public sources—such as team moves, fund launches, co-investments, hiring, and filings—to surface timing and intent rather than relying on static historical profiles. Core capabilities include OSINT-powered signals, live fund discovery, and LP profiles with verified contacts and inbox-ready emails, plus broad family-office coverage. Data hygiene workflows provide change detection and regular re-verification cadences, with premium datasets, API access, and enterprise features mentioned in product copy. Site coverage notes large reach (references around 1.5M LP contacts and >$2T AUM in FAQ and blog references). Pricing is described as an annual subscription with a flat team-wide entry point (roughly $15,500/year) but pricing pages are inconsistent or unavailable. Terms of Use describe annual upfront payments, automatic renewal, and restrictions on scraping and data export. A reported free trial appears in some posts but is not clearly exposed on pricing pages. Given missing pages and mixed snippets, direct confirmation from sales is recommended to finalize pricing, plan features, seat vs. team billing, and data licensing. Recommended next steps include booking a demo and requesting a coverage sample from sales.

Key Features

OSINT-powered signals

Continuous monitoring of public signals (team moves, mandate shifts, fund launches, co-investments, hiring, filings) to surface timing and intent.

Live fund discovery

Identify funds actively raising and surface peer benchmarks and market dynamics.

LP profiles

Verified contact names and inbox-ready emails; allocation history and investment preferences; check sizes and geography filters.

Family-office coverage

Site claims thousands of verified family offices (examples cited: 6,000+).

Data hygiene

Change-detection and contact verification workflows with monthly refresh/re-verification cadence.

Add-ons & enterprise features

Premium datasets, API access, and enterprise features referenced in product copy.

Who Can Use This Tool?

- Fund managers / GPs:Seeking verified family-office/LP intel to speed fundraising and deal sourcing.

- Investor relations teams:To locate LPs and monitor relationships.

- Placement agents:Support fundraising campaigns with LP discovery.

- Corporate development:Identify potential LP partners and co-investors.

- Digital-asset firms:Access OSINT-based LP data for private markets activity.

- Other teams requiring verified LP intel:General purpose investment research and due diligence.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓OSINT-powered signals for timing and intent

- ✓Live fund discovery for fundraising insights

- ✓Verified LP contact details and inbox-ready emails

- ✓Broad family-office coverage

- ✓Data hygiene and regular verification cadence

✗ Cons

- ✗Site has missing pages (404s) and inconsistent pricing references

- ✗Pricing details are not consistently extractable from the site

Related Articles (5)

A practical 2026 playbook guiding fund managers in fundraising to institutional LPs through fund-of-funds.

An OSINT-powered investor intelligence platform FAQ explaining Altss, its audience, and how it outperforms generic databases.

OSINT-backed, practical playbook to raise a first fund in 2025-2026 amid elevated diligence and capital concentration.

A buyer’s guide comparing Altss, PitchBook, Preqin, FINTRX, Dakota, and With Intelligence for Fund I–III fundraising in 2026.

OSINT-powered allocator data enriched with AI verification and manual checks for accuracy and compliance.