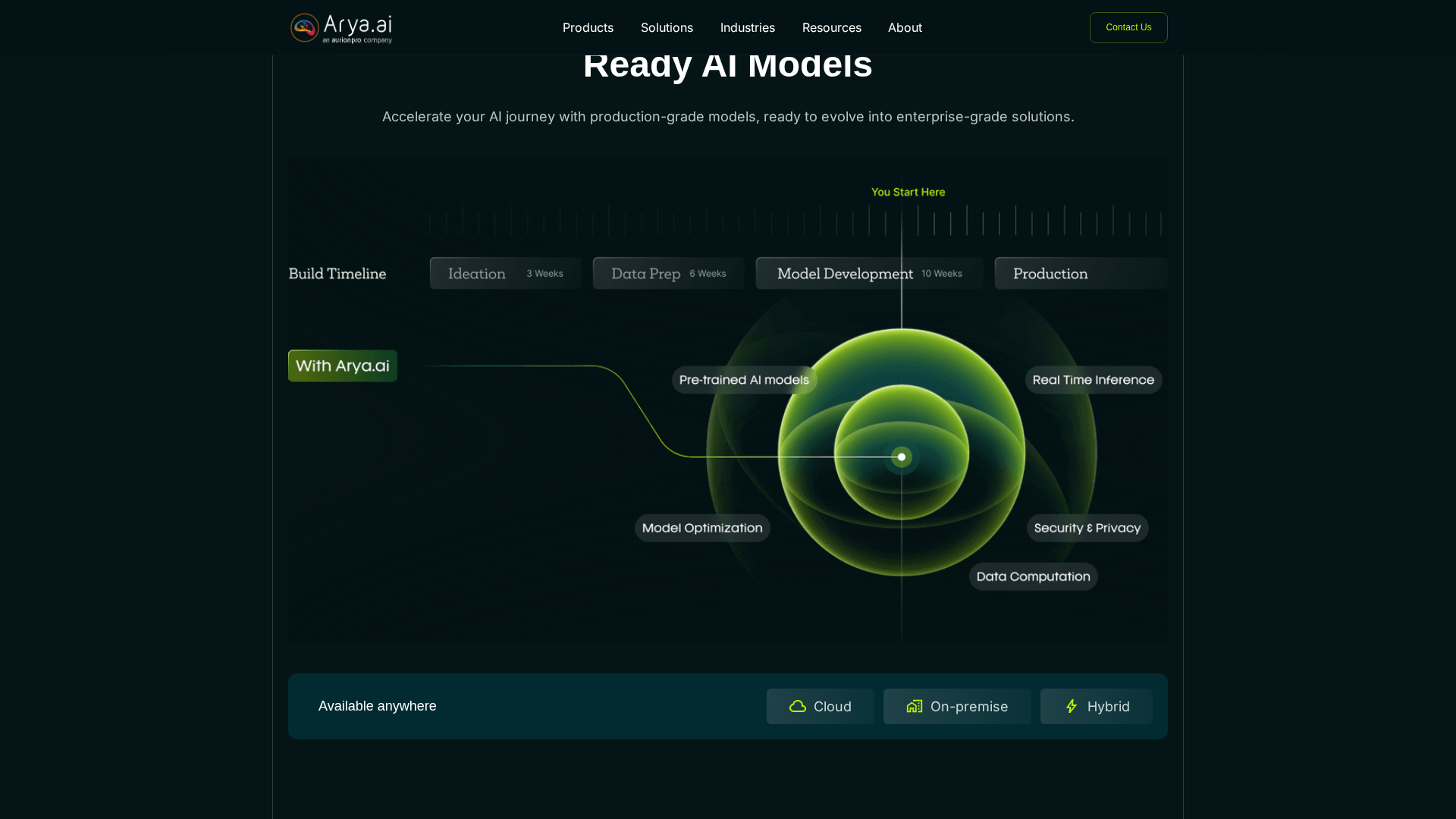

Overview

Arya.ai is an enterprise-focused AI platform for the financial services (BFSI) sector providing a unified stack of pre-trained APIs, a finance-specific LLM, orchestration, and an API gateway. Key components are Apex (a library of 100+ plug-and-play, pre-trained AI APIs for KYC, OCR/document extraction, PII masking, image quality analysis, fraud detection, resume parsing, sentiment, face/biometrics, etc.), Prism (a finance-tailored LLM for contextual understanding of banking and regulatory language; referenced in architecture/blog content but a dedicated /prism page returned 404 during review), Weave (chat-based orchestration layer connecting Prism and Apex to internal systems via endpoints, supporting multi-step LLM-driven workflows while minimizing raw-data exposure), and Nexus (API gateway for traffic management, governance, analytics, security, and multi-API orchestration). The site cites compliance claims including GDPR and ISO/IEC 27001:2022 and notes that Apex states data is not stored. Deployment options include cloud, on-premises, and hybrid (Nexus mentions Kubernetes and serverless deployments). The site references ~350M API calls annually and 11+ years of AI/ML research experience. No public pricing tiers or per-call rates were published; pricing is described on the site as "flexible pay-as-you-go, zero setup costs" and prospective customers are directed to contact sales. Developer resources include an API explorer (api.arya.ai) and blog/product posts; a full, clearly documented public developer pricing/usage guide (detailed rate limits, SLAs, or public pricing) was not found. Recommended next steps from the review are contacting sales ([email protected]), requesting concrete pricing, demo/sandbox access, full developer docs and SLAs, Prism technical brief, ISO evidence, connector catalog, and DPA copies for enterprise evaluation.

Key Features

Apex — Pre-trained AI API Library

100+ plug-and-play, pre-trained APIs for finance-focused tasks (KYC, document extraction/OCR, PII masking, image quality analysis, fraud detection, resume parsing, sentiment, biometrics). Designed for low-code automation of enterprise workflows; Apex page claims data is not stored and cites GDPR and ISO/IEC 27001:2022 compliance.

Prism — Finance-tailored LLM

Domain-specific LLM optimized for banking and regulatory language, intended for contextual understanding and incremental updates without full retraining. Prism is described in architecture/blog content but a dedicated public /prism page returned 404 during review.

Weave — Orchestration & Integration Layer

Chat-based orchestration layer that connects Prism and Apex to internal systems via plug-and-play endpoints, enabling multi-step LLM-driven workflows while minimizing raw-data exposure. Supports on-prem, cloud, and hybrid deployments and lists 100+ integrations (examples: MongoDB, Salesforce, core banking systems).

Nexus — API Gateway & Governance

API gateway for traffic management, governance, plugins, analytics, security, and multi-API orchestration. Deployable on cloud, on-prem/Kubernetes, and serverless.

Compliance & Data Handling

Site cites GDPR and ISO/IEC 27001:2022. Apex claims data is not stored; Weave emphasizes endpoint-level policies to avoid exposing raw data to models. Privacy Policy, Terms, and Data Processing Agreement are available on the site.

Integrations & Deployment Options

Deployment modes include cloud, on-premises, and hybrid. Weave and Nexus reference 100+ connectors (examples provided: MongoDB, Salesforce, core banking systems). Nexus mentions Kubernetes and serverless support.

Who Can Use This Tool?

- Banks:Use Apex APIs and Prism LLM to automate KYC, fraud detection, and regulatory workflows with enterprise integrations.

- Insurers:Automate claims processing, document extraction, and decisioning using Apex APIs and orchestration via Weave.

- BFSI enterprises:Deploy finance-tailored LLMs and pre-built APIs on-prem/cloud for compliance-sensitive production workloads.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Finance-specific offering: dedicated LLM (Prism) and finance-focused APIs (Apex) tailored to BFSI use cases

- ✓Large library of pre-trained APIs (100+), enabling low-code automation of common finance workflows

- ✓Orchestration layer (Weave) plus API gateway (Nexus) supports integration, governance, and enterprise deployment modes

- ✓Compliance claims (GDPR, ISO/IEC 27001:2022) and explicit DPA/Privacy/Terms documents available

- ✓Supports on-prem, cloud, and hybrid deployments and lists many integrations (100+ connectors)

✗ Cons

- ✗No public pricing tiers, per-API or per-call rates, or free-trial details published on the site

- ✗Prism lacks a dedicated public product page (/prism returned 404), reducing discoverability of LLM technical details

- ✗Developer-facing documentation and onboarding guidance (clear rate limits, SLAs, public SDKs) are limited or not clearly published

- ✗Evidence for security certifications (audit reports, certificate numbers) beyond the ISO claim was not provided publicly

- ✗Exact connector list and details of data residency/encryption-at-rest options are not publicly listed

Compare with Alternatives

| Feature | Arya.ai | Malted AI | Gradient Labs |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.3/10 | 8.2/10 | 8.2/10 |

| Finance Specialization | Yes | Yes | Yes |

| Orchestration Capabilities | Yes | Partial | Yes |

| Agent Automation | Partial | Partial | Yes |

| Realtime Processing | Partial | Yes | Partial |

| Deployment Options | Yes | Yes | Partial |

| Compliance Controls | Yes | Yes | Yes |

| API Ecosystem | Yes | Partial | Yes |

| Monitoring & Auditing | Yes | Yes | Yes |

Related Articles (3)

Arya.ai launches PII Masking API to automatically detect and mask sensitive data across text and documents with multi-language and multi-country support.

Aurionpro announces the acquisition of Arya AI to accelerate AI-powered platforms for banks and fintechs worldwide.

Overview of deepfake audio risks, detection approaches, and Arya AI’s real-time Deepfake Audio Detection API.