Overview

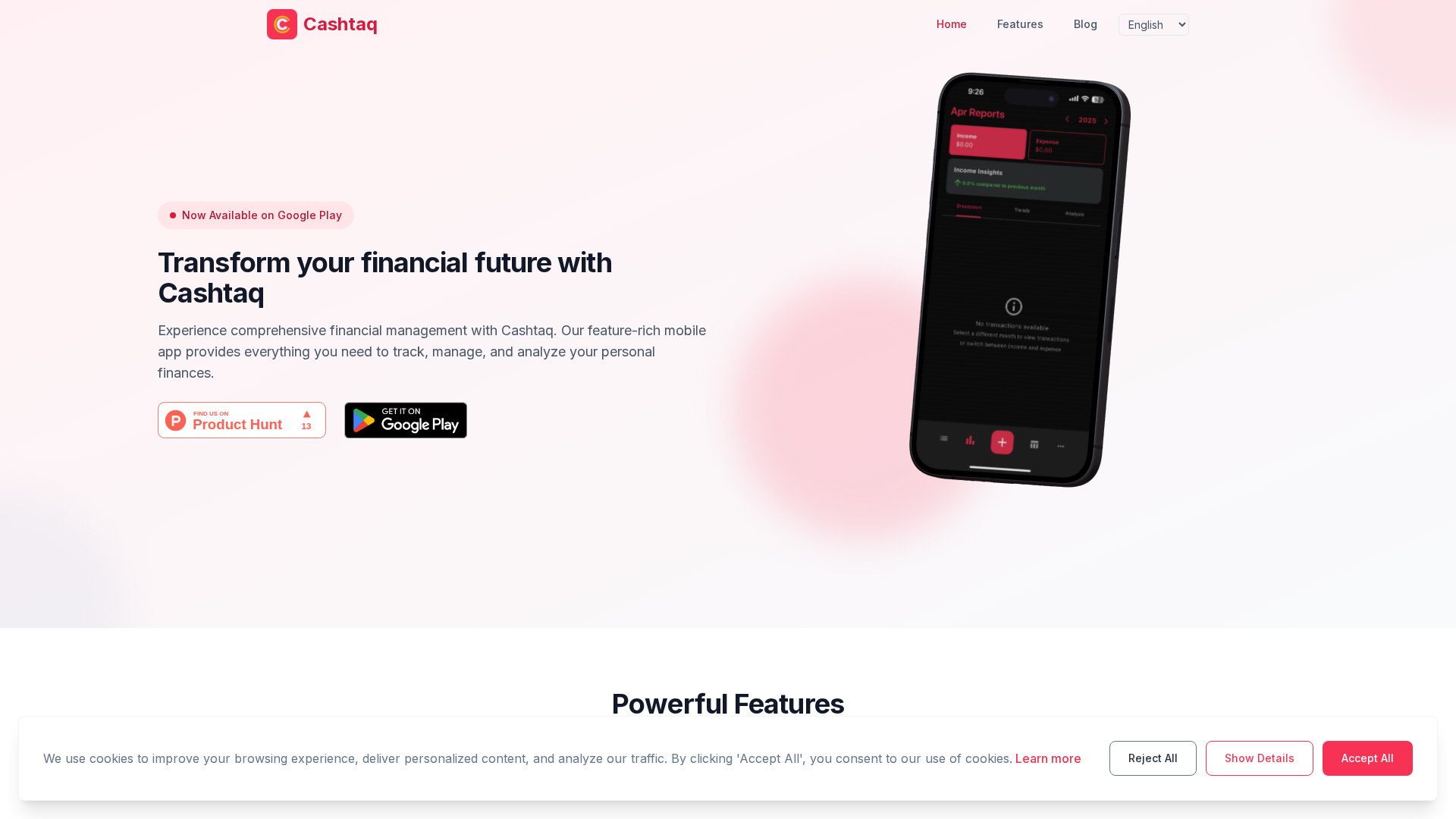

Cashtaq is presented as an AI-powered personal finance app that tracks, budgets, analyzes, and helps grow wealth with real-time insights and multi-account support. This summary, based on a site crawl, highlights a unified financial dashboard that aggregates accounts and balances, transaction management for adding/editing/deleting and categorizing income, expenses, and transfers, and budget goals with real-time progress and alerts. Analytics and reporting cover interactive charts, income vs. expenses, category breakdowns, trends, ROI, and growth tracking. Investment tracking includes diversification analysis, risk assessment, and market opportunity alerts described in the blog. AI-driven insights provide personalized recommendations to optimize savings, investments, and passive income, while getting-started guidance appears in blog content. Security notes reference cloud backup via Supabase, encryption, end-to-end protection, MFA and biometric options, with regular security audits. Privacy policy outlines data collection, sources, legal bases, uses, user rights, and retention. Pricing shows no published plans on the pricing page; Google Play listing may show in-app purchases, and the site notes mobile availability and multiple languages.

Key Features

Unified financial dashboard

Aggregates accounts and balances in a single view.

Transaction management

Add, edit, delete, and categorize income, expenses, and transfers.

Budget goals

Real-time progress tracking and alerts for budget goals.

Analytics and reporting

Interactive charts including income vs. expenses, category breakdowns, trends, ROI and growth tracking.

Investment tracking

Diversification analysis, risk assessment, and market opportunity alerts described in the blog.

AI-driven insights

Personalized recommendations to optimize savings, investments, and passive income.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

Pros will be listed here once they are curated.

✗ Cons

Cons will be listed here once they are curated.

Related Articles (5)

Explore how money psychology shapes wealth and how Cashtaq's tools help you save, invest, and manage money smarter.

Cashtaq blends AI with financial expertise to help you track, budget, and grow your personal finances.

AI-powered personal finance manager with real-time tracking, budgeting, analytics, and secure cloud sync.

Cashtaq blends AI with financial insight to track, manage, and optimize money across accounts with real-time updates.

AI-powered personal finance app Cashtaq helps you track, budget, analyze, and grow wealth with real-time insights and secure cloud sync.