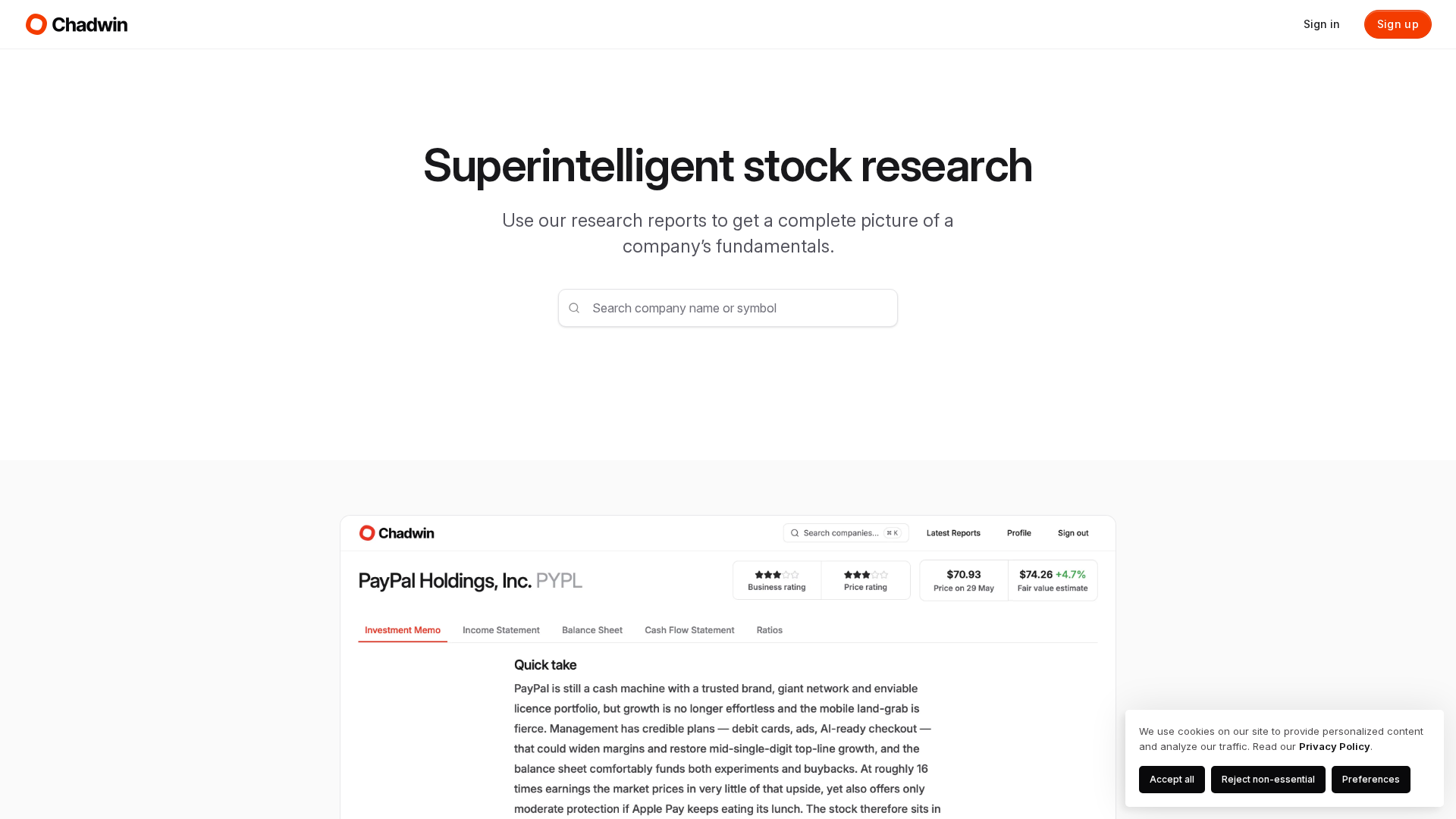

Overview

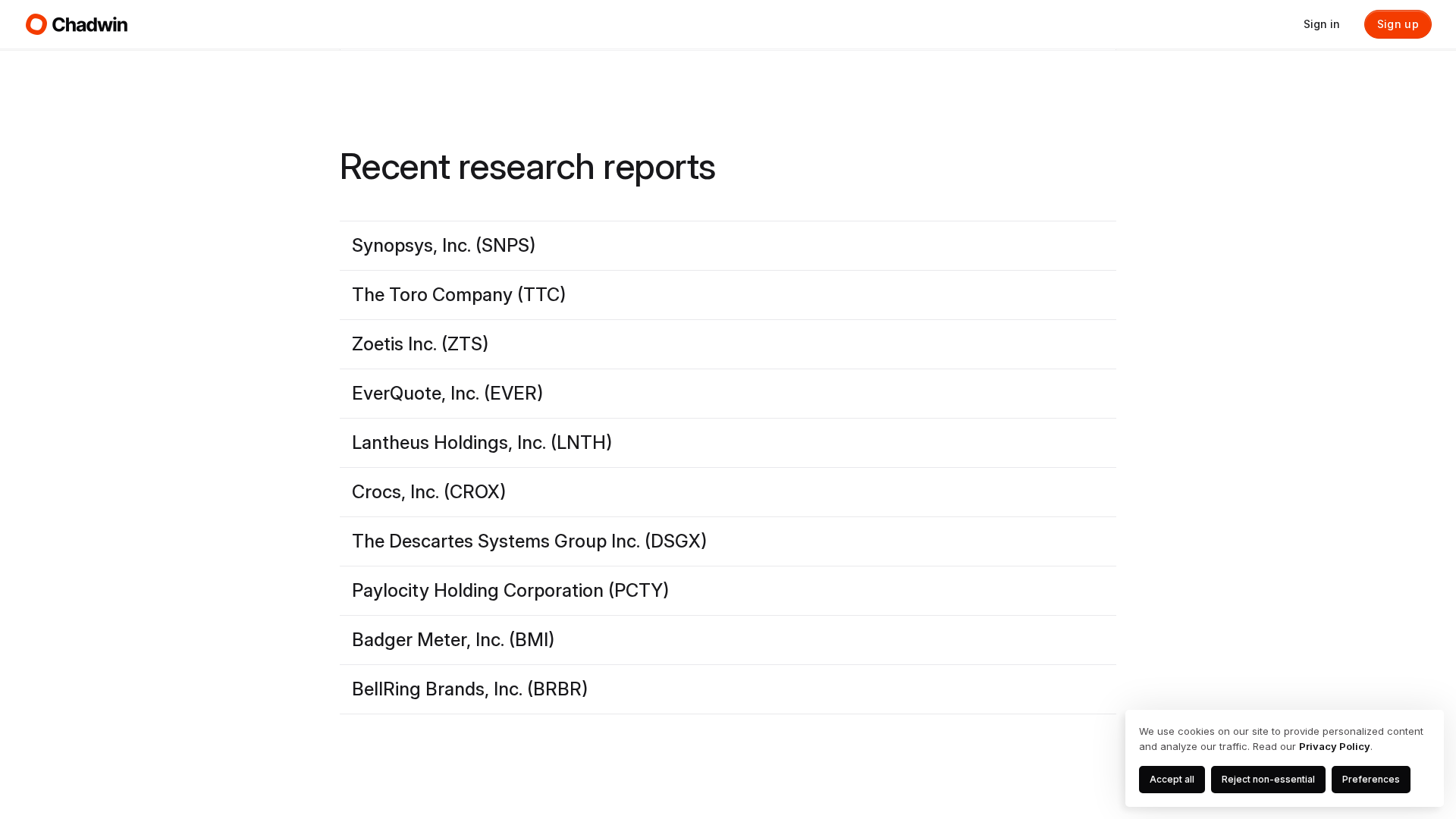

Chadwin is an AI-driven stock research platform that produces concise investment memos, valuation forecasts, and deep quantitative histories to help investors evaluate companies. The service emphasizes both top-line, qualitative analysis (business model, competitive moat, management) and long-span quantitative data (10 years of income statements, balance sheets, and cash flows), plus forward-looking fair-price targets. Chadwin offers two customer-facing modes: a subscription site with full company reports and a developer API (REST/MCP) that delivers structured qualitative intelligence and moat analyses for thousands of US-listed companies. The platform aims to make institutional-style research accessible and automatable while offering pay-as-you-go API pricing for integrations.

Key Features

AI-Powered Research

Generates concise investment memos and narrative analyses derived from company filings, filings history, and public sources.

Ten-Year Financial Data

Provides 10 years of income statements, balance sheets, and cash flow statements for quantitative analysis.

Fair-Price Targets & Valuation Scenarios

Produces scenario-based DCF/valuation outputs and price targets to inform buy/sell decisions.

Moat & Business Model Analysis

Structured moat taxonomy and business-quality assessments to identify durable competitive advantages.

Industry & Competitor Analysis

Summaries of competitive landscape and industry dynamics within reports.

Developer API (Qualitative Intelligence)

REST/MCP endpoints for structured moat analysis and company-level qualitative insights (pay-as-you-go at $0.02/request).

Who Can Use This Tool?

- Individual Investors:Use concise AI research and 10‑year financials to evaluate long‑term stock ideas.

- Equity Analysts:Augment research workflows with fast qualitative memos and valuation scenarios.

- Developers / Fintechs:Integrate structured qualitative intelligence via REST/MCP for apps and dashboards.

- Value Investors:Analyze business quality and valuation with moat analysis and price targets.

Pricing Plans

Access to all company reports with financials, analysis, and price targets.

- ✓Access to all company reports

- ✓10 years of financial statements

- ✓Stock price targets

- ✓Business model analysis

- ✓Industry & competitor analysis

- ✓Competitive moat analysis

- ✓Investment thesis

- ✓Financial analysis

Pay-as-you-go API access billed per request at $0.02 each.

- ✓$0.02 per request

- ✓Data for thousands of US-listed companies

- ✓Available via REST API and MCP

- ✓Generous rate limits

Pros & Cons

✓ Pros

- ✓Deep financial history: 10 years of income statements, balance sheets, and cash flows.

- ✓AI-driven, structured qualitative research (investment memos, moat analysis).

- ✓Includes forward-looking fair-price targets and valuation scenarios.

- ✓Developer API (REST/MCP) with pay-as-you-go pricing for integration and automation.

- ✓Concise, readable reports that combine qualitative and quantitative analysis.

✗ Cons

- ✗Limited third-party reviews and public track record (few independent reviews found).

- ✗No free trial available to evaluate product hands-on before subscribing.

- ✗Pricing page content at /pricing appeared unavailable when crawled (404/empty), causing minor transparency friction.

- ✗Coverage appears focused on US-listed companies (non-US coverage not clearly documented).

Related Articles (4)

AI-driven stock research delivering deep fundamentals, financials, and fair-price targets for smart, long-term investing.

Chadwin offers the first API for qualitative company intelligence, delivering structured moat analyses (e.g., NVIDIA) via REST and MCP.

May’s best under-$2B small-cap picks: Vital Farms, Ituran, and IRadimed.

A practical overview of Chadwin’s two-axis ratings and three-part investment framework for evaluating value in small-cap stocks.