Overview

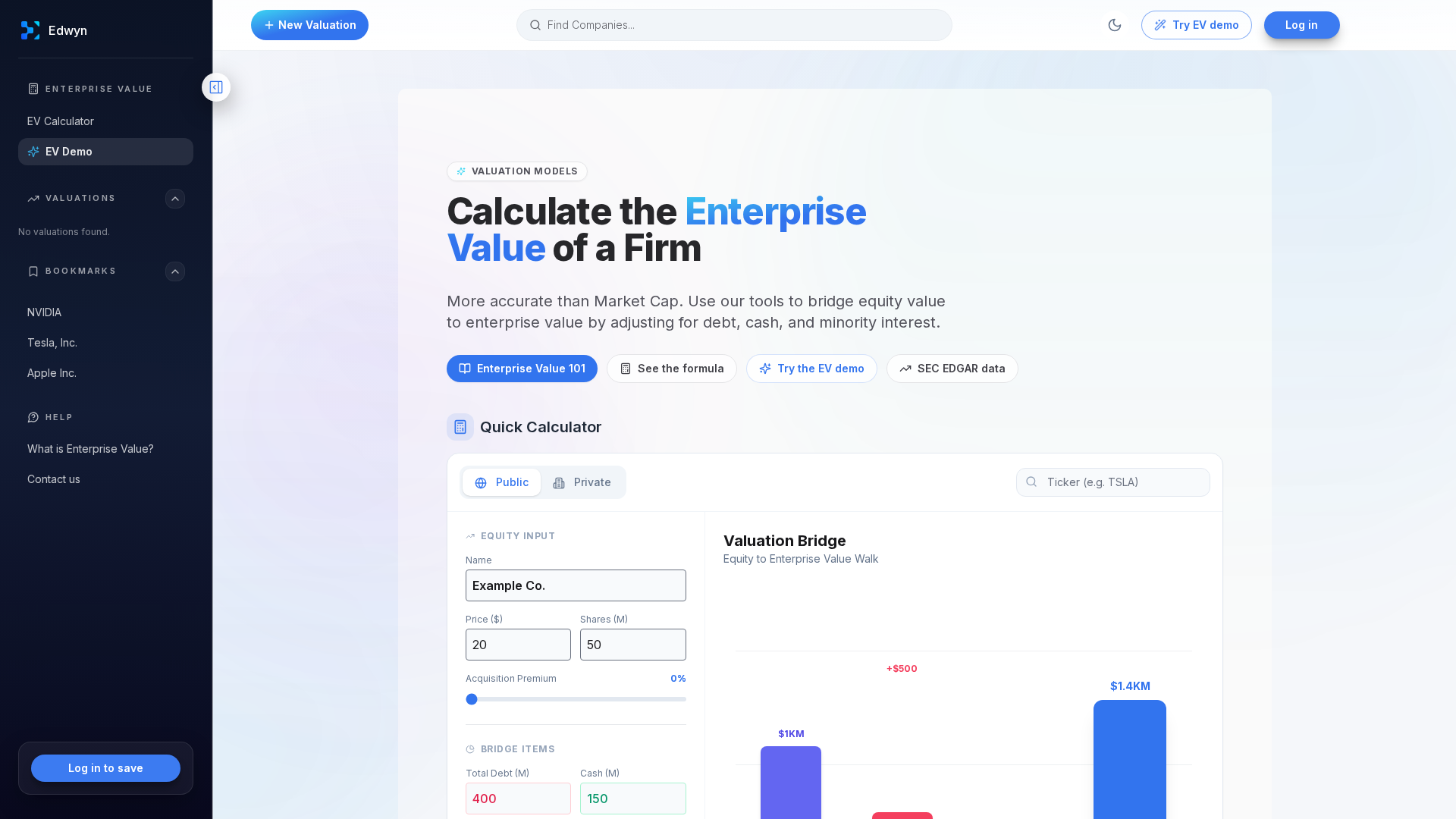

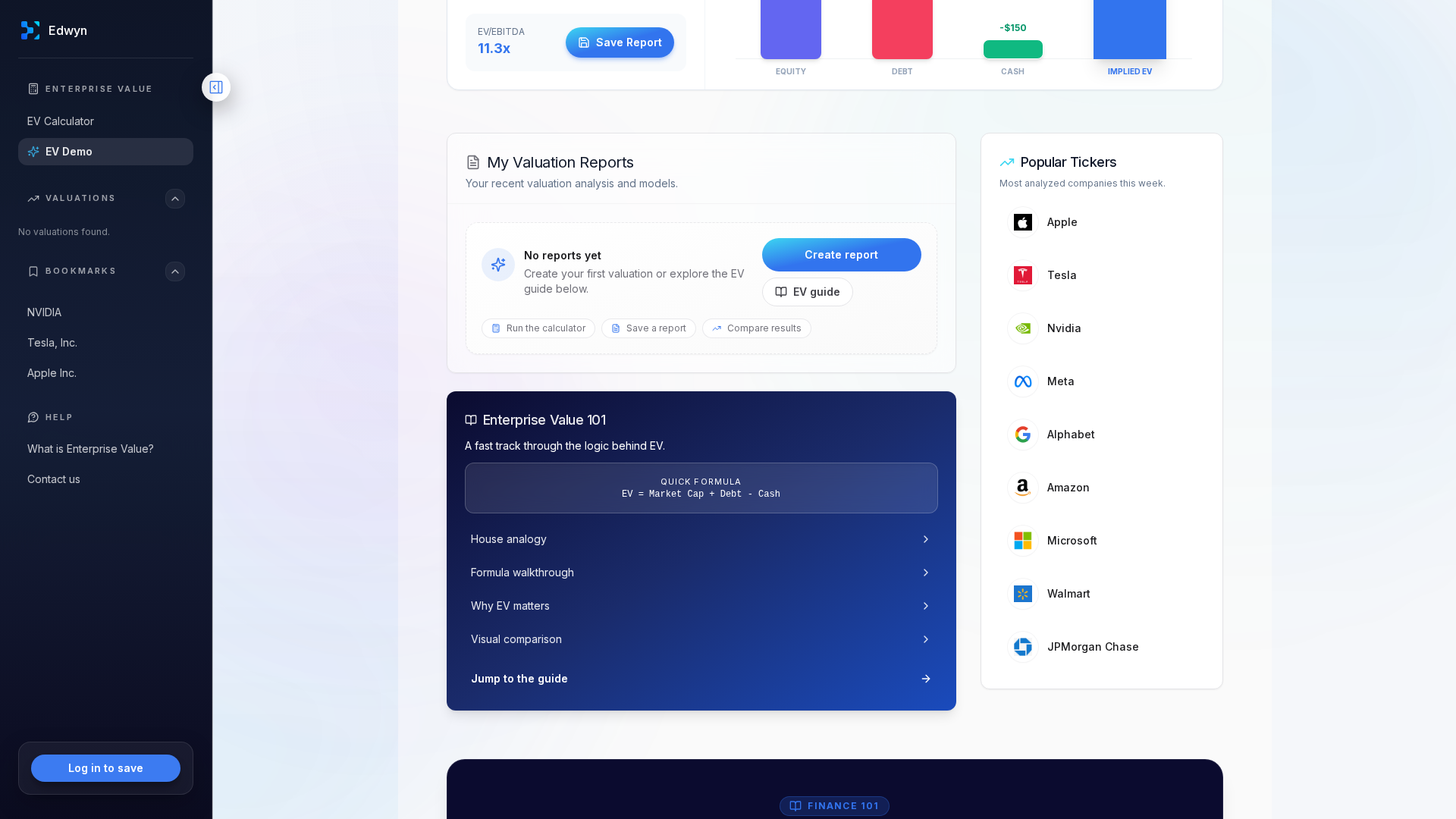

Edwyn is a web-first valuation platform that combines automated SEC EDGAR ingestion, cleaned multi‑year financial statements, peer benchmarking, and built‑in valuation calculators to produce enterprise value estimates and comparative analyses. Users can run an interactive no-login walkthrough/demo, pull structured financials from SEC filings, apply multiples (EV/EBITDA, P/E, P/S), and export CSVs or publish valuation reports. The product targets finance professionals and business owners who want a reproducible, auditable workflow from raw filings to client-ready valuation outputs. Edwyn emphasizes speed, transparency of data sources (SEC filings and market prices), and scenario-driven sensitivity analysis.

Key Features

SEC EDGAR Data Ingestion

Automates pulling 10-K/10-Q filings and extracts balance sheet, income statement, and cash flow series across multiple years.

Interactive Valuation Walkthrough

No-login demo allowing users to apply comparables and see live implied value sensitivity.

Peer Benchmarking & Multiples

Prebuilt comparable selection and calculation of EV/EBITDA, P/E, P/S and other multiples for cross-company comparison.

Valuation Calculators & Scenario Analysis

Built-in calculators to apply median/mean multiples and run sensitivity tests on inputs.

CSV Export & Reporting

Download structured data and publish client-ready valuation reports for sharing and archival.

Save & Share (signed-in features)

Sign-in enables saving valuations, exporting reports, and sharing across teams (demo indicates these features require sign-in).

Who Can Use This Tool?

- Investors:Quickly screen companies and benchmark implied enterprise values with public filings.

- Analysts:Build reproducible, auditable valuation models using SEC data and exportable reports.

- Corporate Finance:Run comparable analyses and prepare client-ready valuation reports for transaction or strategic work.

- Business Owners:Estimate company worth via comparables and scenario-driven multipliers for planning or sale.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Direct SEC EDGAR ingestion and multi-year financial extraction for reproducible valuations.

- ✓Interactive no-login demo that showcases live comparables and sensitivity analysis.

- ✓Peer benchmarking (EV/EBITDA, P/E, P/S) and ability to build comparative valuation reports.

- ✓CSV export and report publishing to integrate outputs into external models and presentations.

- ✓Clear support/contact emails and stated 1–2 day response for inquiries.

✗ Cons

- ✗No public pricing plans or clear starting price on the site.

- ✗Some pages show an empty state ("No valuations found"), suggesting limited live data or a demo/preview state.

- ✗Limited public reviews or community presence to corroborate market traction.

- ✗Documentation and methodology detail (specific algorithms, aggregator partners) are minimal on visible pages.