Overview

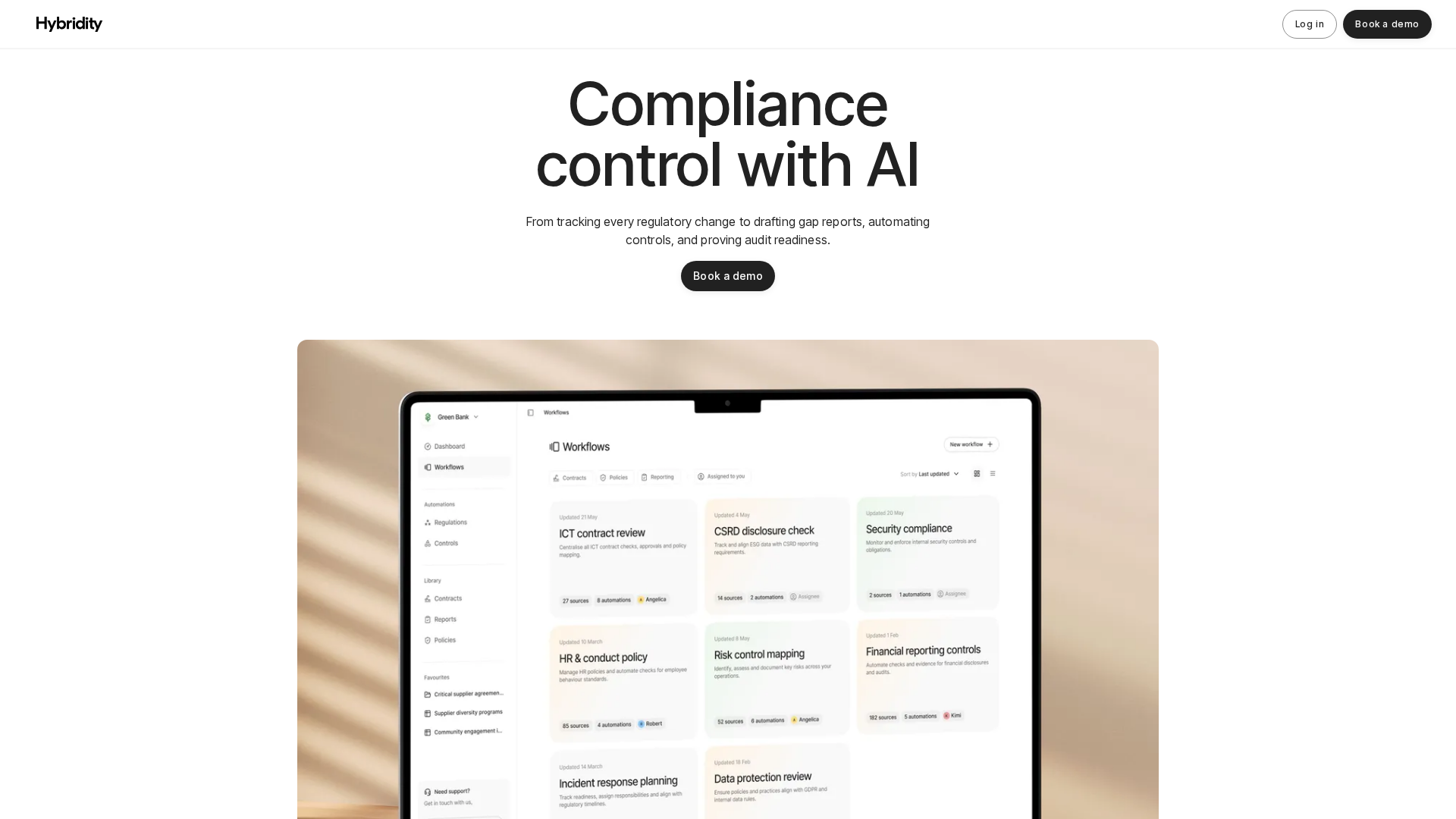

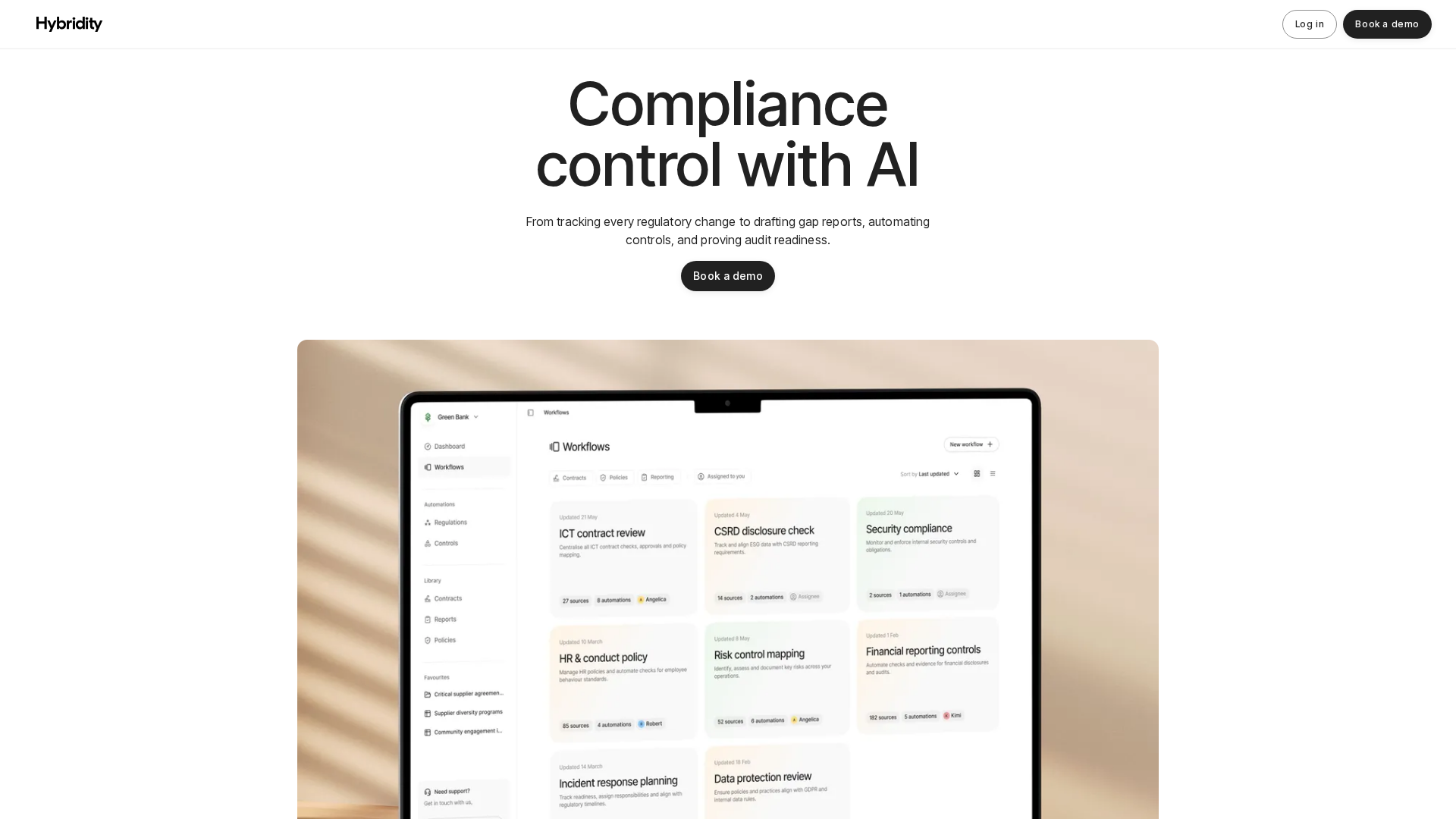

Hybridity is a Swedish SaaS startup (founded 2023) that builds AI agents and a compliance platform to automate regulatory compliance and ESG reporting. The platform codifies rules, runs gap analyses, automates controls and produces audit-ready evidence and reports. Publicly called-out target use cases include DORA, GDPR, CSRD (ESRS / XBRL export), VSME reporting and contract/IT vendor reviews for financial services. The website references customers including large banks and insurers in case studies and press items. Core capabilities presented on the site: automated regulatory mapping and continuous tracking of regulatory change; automated gap analysis mapping rules to existing disclosures and documents; automated contract and vendor reviews for missing clauses and resilience requirements; an AI report generator to assemble simple and complex analyses into reports; audit-ready evidence and export to regulatory formats (XBRL mentioned for CSRD); and a combined expert validation / second-opinion offering. The site describes a five-step workflow: discover, explore (test with own data), kickstart (onboarding), work smart (use platform), and optimize. Publicly available company facts from the site and pressroom: founded in 2023; headquarters/address snippet in footer: Tyska Brinken 30, Stockholm (© 2025 shown on pages); a seed funding announcement reporting 23 million SEK (press release dated 2025-03-14); partnerships noted include Google Cloud certified build partner (April 2024) and GRC Watch & Verified partnership (2025). Press contact listed for media inquiries: Joakim Jörlander. Careers contact: [email protected]. Privacy and site notes: the privacy policy emphasizes a privacy-first stance with no third-party tracking/advertising cookies, anonymized analytics and short session retention (page indicates 24-hour retention), and emphasis on aggregated insights rather than user tracking. Pricing and trials: the site does not list public pricing plans or rates. The CSRD and VSME pages explicitly mention a free test / "no binding" option and encourage booking a demo, but no detailed pricing tiers are publicly listed; the practical conclusion is that you must contact sales (Contact Sales form/email or book a demo) to obtain pricing and pilot/trial terms. Gaps and items not publicly available on the site: no detailed pricing plans, seat/user or consumption model or contract terms posted; no public SLA, SOC/ISO/security certification details or detailed data residency information (these appear to be provided during sales discussions); and no complete public developer/API documentation or public demo sandbox link. Recommended next steps (as noted): book a demo to request pricing, pilot options and a test account; request customer case studies or references for your exact use case; request security/compliance materials (SaaS security posture, data residency, encryption, SOC/ISO reports) if needed for procurement; and ask Sales for example pricing models and typical deployment costs if specific pricing models are required.

Key Features

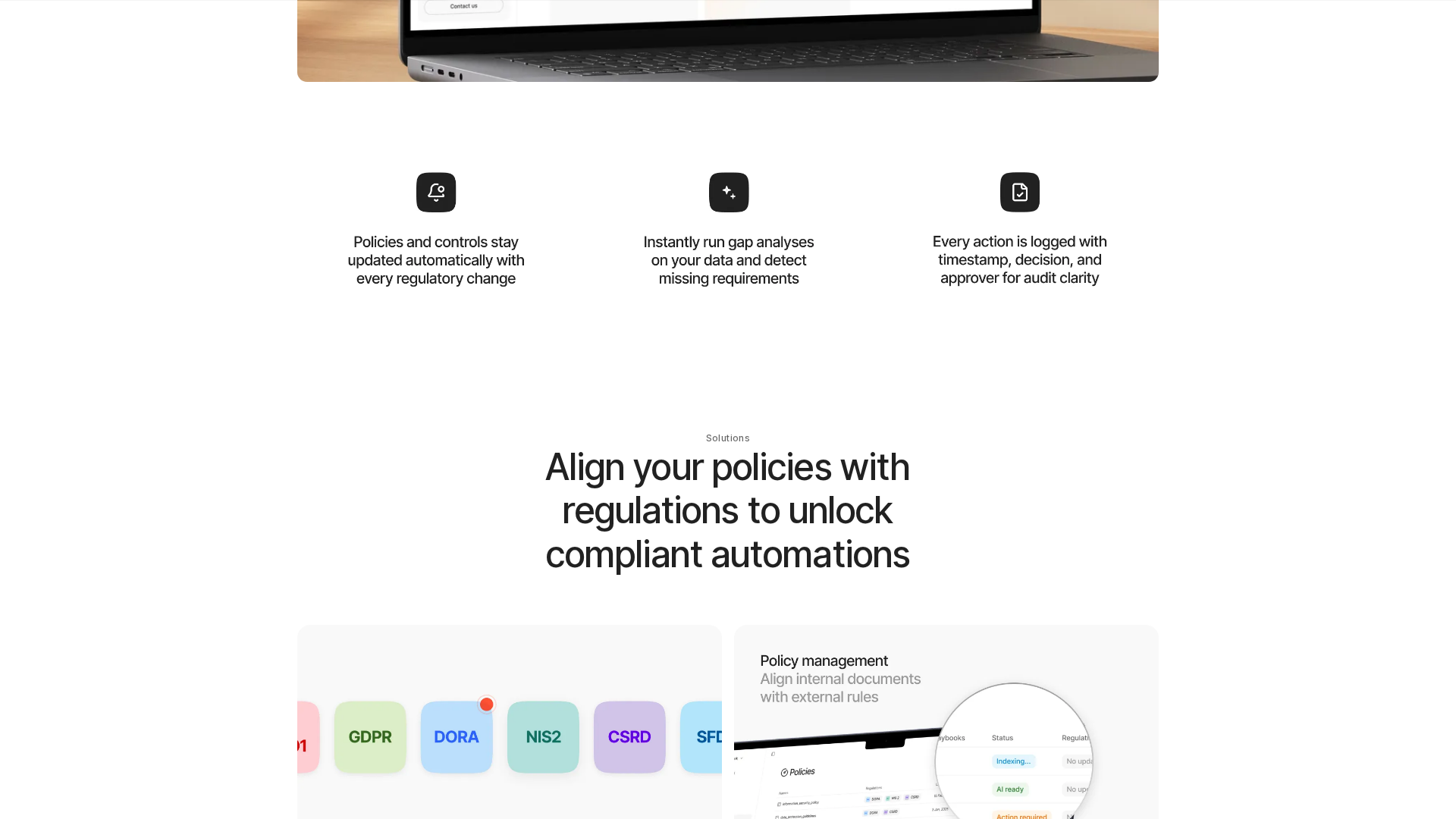

Regulatory mapping & continuous tracking

Automates mapping of regulations and continuously tracks regulatory change relevant to customer scope.

Automated gap analysis

Performs automated gap analyses that map rules to existing disclosures and documents.

Contract & vendor reviews

Automated contract and IT vendor reviews scanning for missing clauses and resilience requirements.

AI report generator

Assembles simple and complex analyses into audit-ready reports.

Audit-ready evidence & export

Produces audit-ready evidence and supports export to regulatory formats (XBRL mentioned for CSRD).

Expert validation / second opinion

Combines automation with expert validation and a second-opinion offering.

Who Can Use This Tool?

- Compliance teams:Use for automating regulatory mapping, gap analysis and producing audit-ready compliance reports.

- Financial services:Banks and insurers using platform for contract/vendor reviews, DORA and regulatory reporting workflows.

- Sustainability/ESG teams:Teams using CSRD/ESRS mapping, XBRL export and materiality assessments for ESG reporting.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Automates regulatory mapping, gap analysis, contract reviews and continuous tracking

- ✓Produces audit-ready evidence and supports XBRL export for CSRD

- ✓Combines automation with expert validation / second opinion

- ✓Privacy-first approach on site (no third-party tracking, anonymized analytics)

✗ Cons

- ✗No public pricing plans, tiers or detailed pricing information

- ✗No public SLA or published SOC/ISO/security certification details

- ✗No public developer/API documentation or demo sandbox link

Compare with Alternatives

| Feature | Hybridity | Robin AI | Holistic AI |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.2/10 | 8.1/10 | 8.3/10 |

| Regulatory Coverage | Yes | Partial | Yes |

| ESG Reporting | Yes | No | No |

| Audit Evidence Export | Yes | Partial | Yes |

| Agent Automation | Yes | Partial | Partial |

| Contract Analysis | Yes | Yes | No |

| Expert Validation | Yes | Partial | Partial |

| Data Integrations | Partial | Yes | Yes |

| Governance & Explainability | Partial | Partial | Yes |

Related Articles (3)

A look at Hybridity's hybrid fund companies and their approach to modern asset management.

AI-driven automation unifies DORA, GDPR, and CSRD compliance with automated reviews, gap analysis, and audit-ready reporting.

Hybridity outlines AI compliance progress through funding, partnerships, and media momentum.