Overview

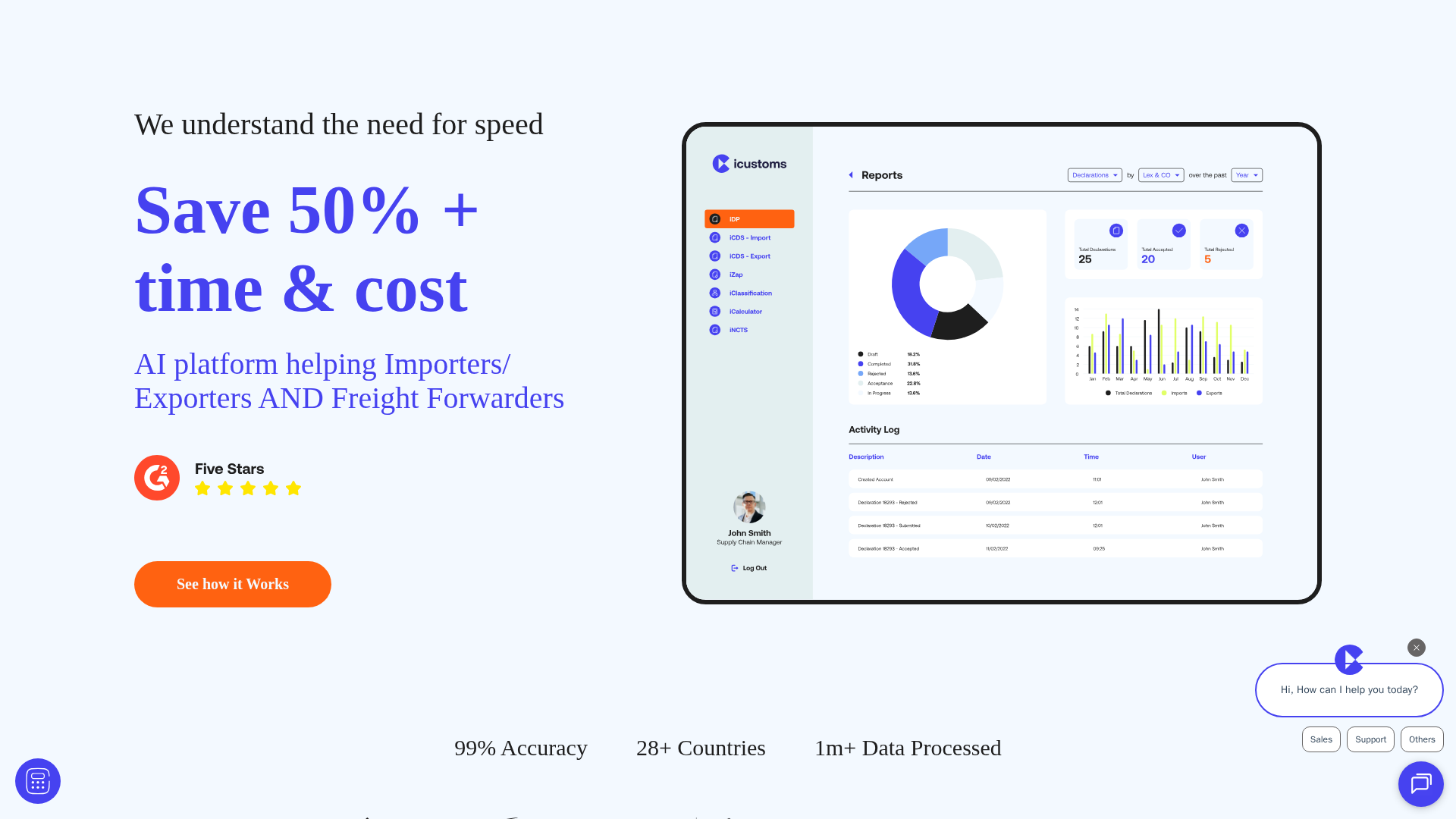

iCustoms is an AI-driven trade compliance and customs automation platform that automates HS code classification, customs declarations (including HMRC CDS for the UK), duty & tax calculations, document extraction, and compliance screening. It supports bulk uploads, API integrations, real-time dashboards, and landed-cost calculations to reduce manual work, speed clearance, and help avoid penalties by aligning with WCO and national customs standards. The platform targets importers, exporters, carriers, and logistics teams and emphasizes ease of deployment and integration across multiple markets. (Not found: independent benchmarks or detailed public case studies.)

Key Features

HS Code Classification (iClassification)

Automatically suggests HS/HTS codes across 32+ jurisdictions; supports single and bulk classification via CSV or API.

Customs Declaration (iCDS for UK & other flows)

Guided declaration workflows with validation (HMRC CDS integration), auto-correction suggestions, and single/bulk submission.

Intelligent Document Processing (IDP)

AI-powered extraction from shipment documents to reduce manual data entry and speed filing.

Landed Cost Calculator (iCalculator)

Instantly estimates duties, taxes, and total landed cost using tariffs and product descriptions.

Compliance Screening & Rule Validation

Screens for restricted goods, regulation checks, and WCO-aligned tariff updates.

Integrations & APIs

Integrates with courier management systems (DHL, FedEx, Royal Mail, UPS etc.), TMS/WMS, and exposes APIs for automation.

Who Can Use This Tool?

- Importers:Prepare accurate customs declarations and landed cost estimates for imported goods.

- Exporters:Automate tariff classification and file export declarations to speed clearance and reduce errors.

- Freight Carriers:Automate carrier customs filings, tariff coding, and integrate with courier management systems.

- E-commerce Businesses:Provide instant landed-cost estimates and compliance checks for high-volume online shipments.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓AI automation for HS code classification and customs declarations (claims of very high accuracy).

- ✓Broad geographic coverage: supports 28+ / 32+ countries depending on page (EU, UK, US, China, Canada, etc.).

- ✓Integrations with courier/TMS systems and HMRC CDS; API and bulk upload support for large catalogs.

- ✓Range of useful features (landed-cost calculator, intelligent document processing, real-time dashboards).

- ✓Credibility signals: awards and experienced leadership cited on About page.

✗ Cons

- ✗No public, detailed pricing table or plan breakdown discovered.

- ✗Accuracy and time-savings claims appear marketing-oriented; limited independent benchmarks or public case studies found.

- ✗Some platform availability details (desktop apps) and exact launch year not publicly listed.

Compare with Alternatives

| Feature | iCustoms | Quickcode ai | super.AI |

|---|---|---|---|

| Pricing | N/A | $749/month | N/A |

| Rating | 8.3/10 | 8.2/10 | 8.3/10 |

| HS Classification Depth | 28+ country HS coverage | Real-time global HS lookup | No HS classification |

| Declarations Coverage | Partial | No | No |

| Document Extraction | Yes | No | Yes |

| Human-in-Loop | No | Yes | Yes |

| Integration Ecosystem | Yes | Yes | Yes |

| Alerts & Monitoring | Partial | Yes | Partial |

| Reporting & Dashboards | Yes | Yes | Partial |