Overview

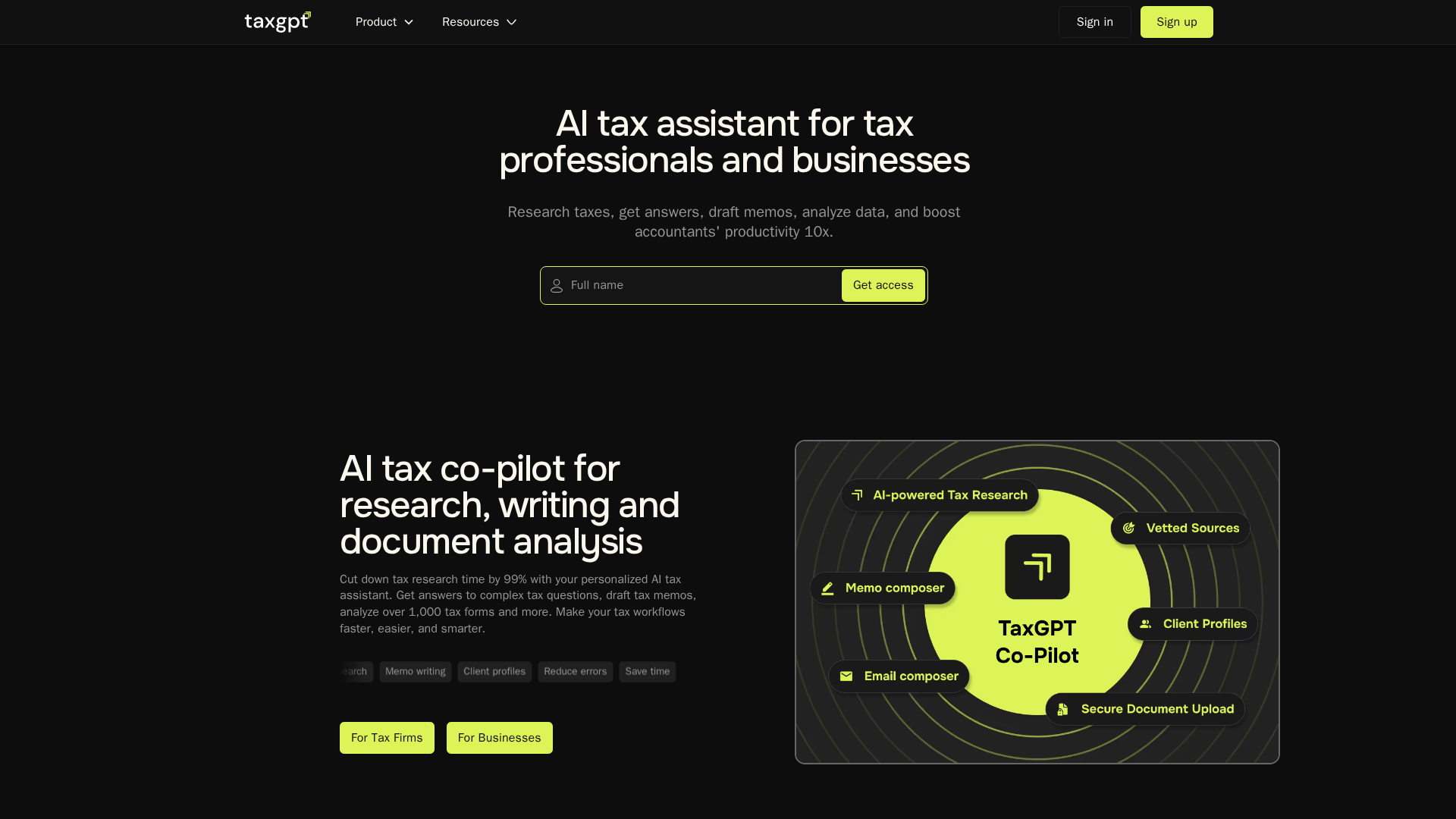

TaxGPT is an AI-powered tax co‑pilot designed for individuals, tax professionals, accountants, and businesses. It provides fast, cited tax research from primary sources, draftable tax memos and client communications, multi-jurisdiction comparisons, secure document upload and automated review (Agent Andrew), and client-context intelligence across engagements. The platform emphasizes security (AES-256, SOC 2 Type II), daily updates to tax sources, and workflow integration to reduce research and response times. Launched to serve thousands of practitioners, it offers a free individual tier and enterprise/team pricing by quote. Pricing page was returning 404 at time of capture; enterprise pricing and per-seat details are provided by sales/contact. Public developer/API documentation was not found on the site. Sources used for this summary: TaxGPT homepage, product pages, FAQs, security page, and blog.

Key Features

Up-to-date Tax Research

Fast, cited answers using primary federal, state, and Canadian tax sources; updates daily to reflect rulings and guidance.

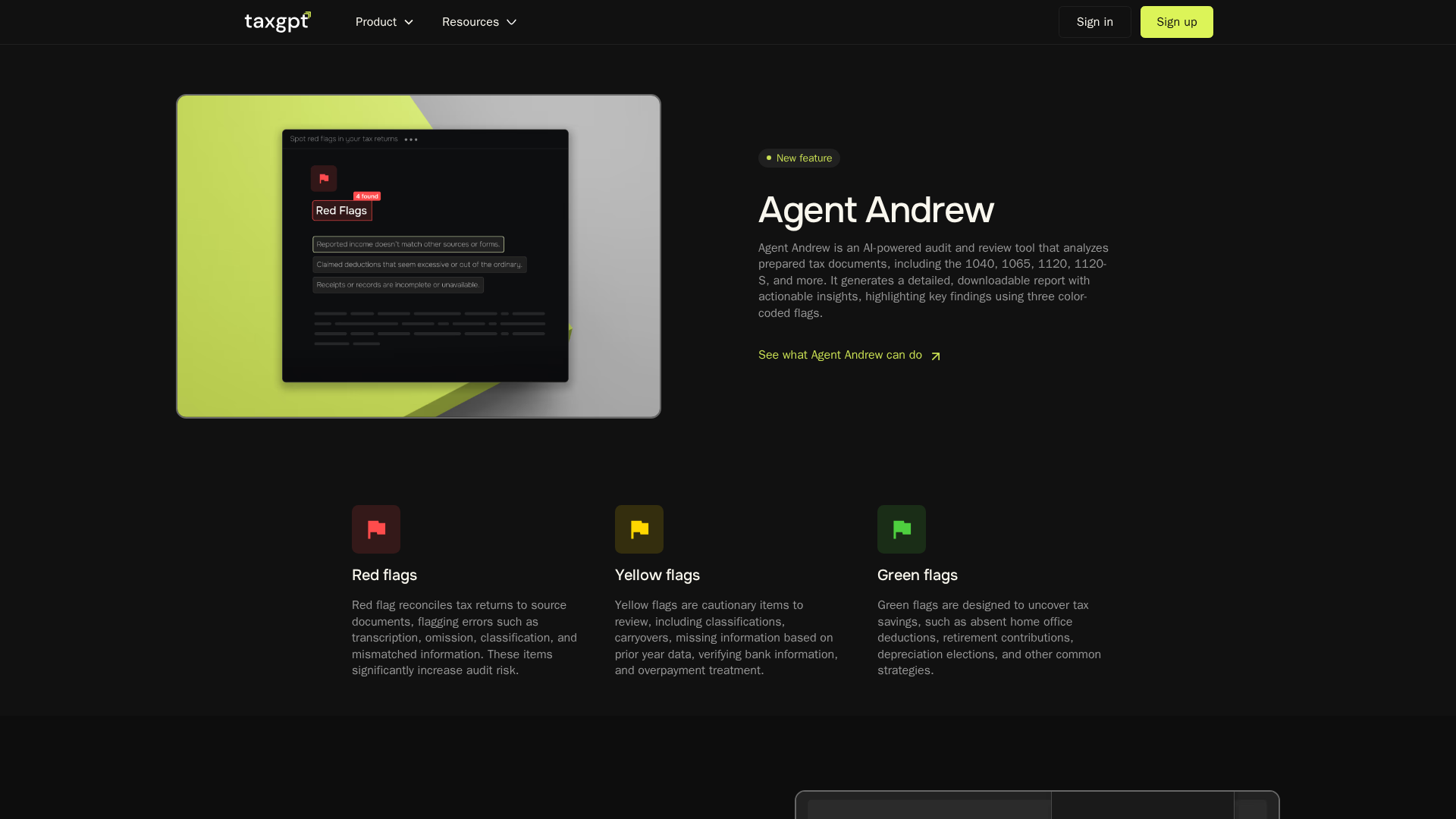

Agent Andrew — Automated Review & Audit Tool

Upload prepared returns (1040, 1065, 1120, 1120-S) and receive color-coded flags (red/yellow/green) and a downloadable review report.

Document Upload & Extraction

Secure upload of PDFs/images with data extraction to query filings, notices, and client documents interactively.

Tax Writer

Drafts professional, customized client communications, memos, IRS notice responses, and other tax writing in firm voice.

TaxGPT Matrix (Multi-jurisdiction Comparisons)

Produce fully cited comparison tables across jurisdictions, exportable to Excel/PDF for reporting.

Client Intelligence & Contextual Profiles

Remembers client context, entity structures, filing history, and pulls that into research and writing jobs with an audit trail.

Who Can Use This Tool?

- Tax Professionals:Perform rapid, cited tax research and draft memos, notices, and opinion letters.

- Accountants / Firms:Scale firm workflows, automate return reviews, and manage clients/documents securely.

- Businesses:Get up-to-date tax guidance, multi-state comparisons, and compliance support for decisions.

- Individuals:Discover eligible deductions, get form guidance, and receive explanatory tax answers for filing.

Pricing Plans

Free access for individuals to ask tax questions, discover deductions, and get form guidance.

- ✓Up-to-date tax answers and deduction discovery

- ✓Guidance for common individual forms (1040, 1099, Schedule C, Schedule SE)

- ✓Security via AWS/Azure hosting claims

- ✓Access to the AI tax assistant interface

Enterprise/team plans priced per users and requirements; tailored to firm size and workflow needs. Pricing provided by quote; contact sales for exact per-seat/tiered pricing.

- ✓Full TaxGPT suite (Research, Tax Writer, Matrix, Client Intelligence)

- ✓Secure document upload, automated reviews (Agent Andrew)

- ✓Multi-jurisdiction/state-by-state matrix and exports

- ✓Role-based access, MFA, SOC 2 Type II compliant infrastructure

- ✓Onboarding, demos, support, and training for firms

Pros & Cons

✓ Pros

- ✓Specialized tax-focused model trained/verified on primary tax sources (IRS code, regs, cases)

- ✓Agent Andrew automated review that flags red/yellow/green issues in returns/documents

- ✓Strong documented security posture (AES-256, SOC 2 Type II, MFA, RBAC) and privacy commitments

- ✓Multi-jurisdiction support and Matrix exports for state comparisons

- ✓Free individual tier and 14-day trial reduces evaluation friction

✗ Cons

- ✗No public detailed pricing tiers on the website (pricing page returned 404), requires sales contact

- ✗Some website pages contain duplicated or repetitive content (site polish issues)

- ✗Potential learning curve for smaller firms or non-technical users given breadth of features

- ✗Not a tax-filing service—provides research and guidance but does not file returns directly

Compare with Alternatives

| Feature | TaxGPT | Automaited | Harvey |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.2/10 | 8.4/10 | 8.4/10 |

| Research Depth | Tax-specialist up-to-date research | General enterprise automation | Law-focused deep research |

| Automated Review | Yes | Partial | Partial |

| Document Extraction | Yes | Yes | Yes |

| Jurisdiction Coverage | Multi-jurisdiction comparison matrix | Configurable via connectors | Configurable for legal jurisdictions |

| Workflow Integration | Yes | Yes | Yes |

| Client Context | Yes | Partial | Yes |

| Auditability & Governance | Yes} | Yes | Yes |

Related Articles (2)

TaxGPT outperforms general AI in tax research with a robust, credibly sourced output designed for defensibility.

Promotes TaxGPT as a zero-hallucination, source-backed tax AI that outperforms general AI with a tax-focused knowledge graph and workflow OS.