Overview

UrCITY (short for UR Cloud Intel for Trade & Yields) is a web-first platform combining AI-driven short- to mid-horizon stock forecasts with a structured investment education playbook. The site publishes two forecasting formats — binary directional signals and numeric percentage estimates — across 5-, 10-, and 20-market-day horizons, and annotates outputs with confidence labels (High / Medium / Low). Alongside the forecasting dashboard, UrCITY offers a multi-part Investment Guide (13 articles) that covers basics, strategy comparisons, practical techniques like DCA and dividend investing, options hedging, and guidance for turning AI signals into tradable strategies. The site emphasizes educational use, clear disclaimers (not financial advice), and transparency through Terms and Privacy pages. Key site pages include daily/top free predictions, a list-of-stocks-and-symbols directory, About, Contact, and policy documents.

Key Features

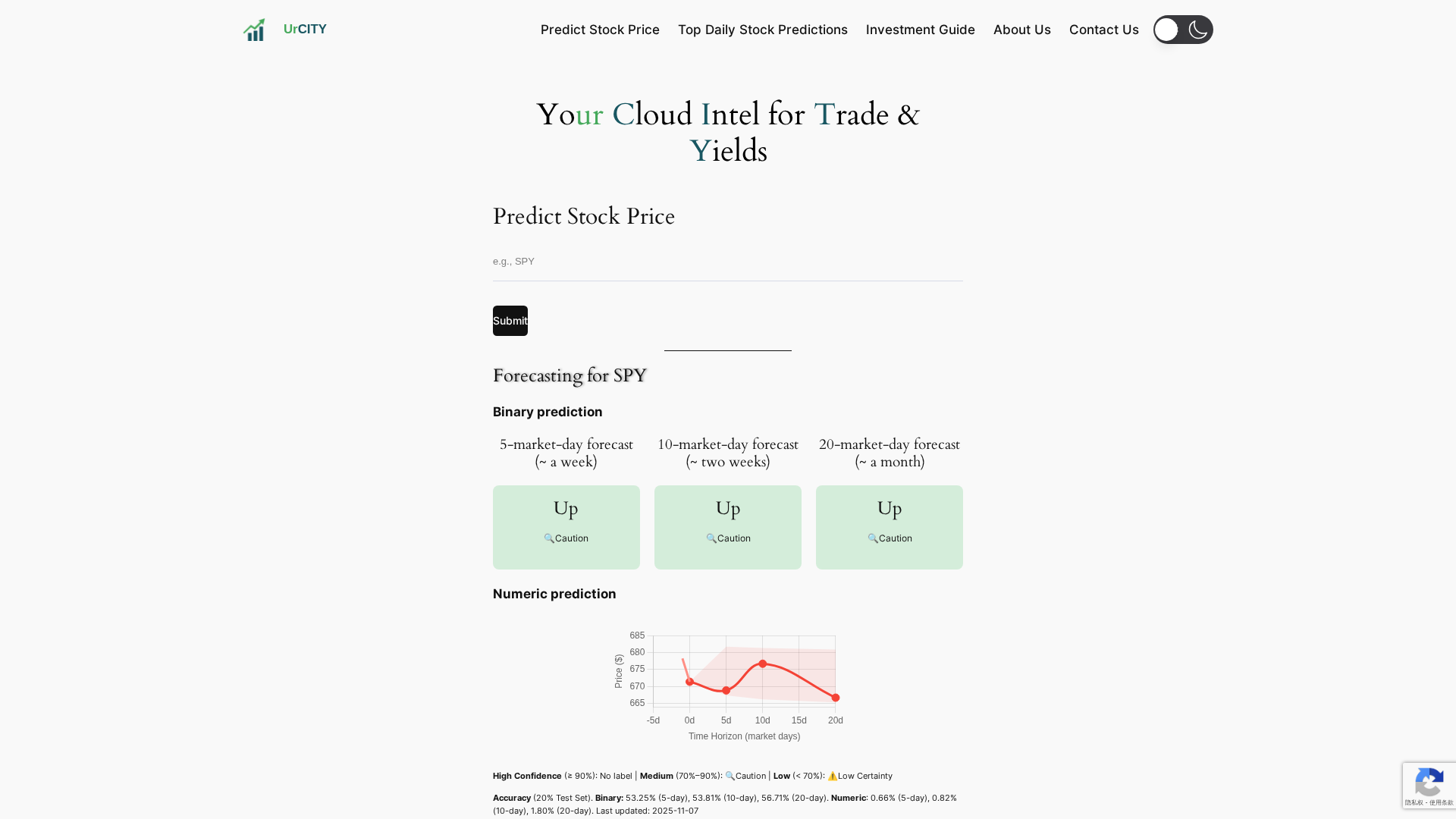

AI Forecasts (5/10/20-day horizons)

Produces directional (binary) and numeric (percentage) forecasts for 5, 10, and 20 market days to support short- and mid-term decisioning.

Dual Prediction Modes (Binary & Numeric)

Binary predictions give Yes/No directional signals; numeric predictions provide estimated percentage moves—useful for different trading styles.

Confidence Labels & Accuracy Metrics

Forecasts are annotated with confidence tiers (High ≥90%, Medium 70–90% with caution tag, Low <70% with low-certainty tag) and the site publishes backtest/live-test metrics for transparency.

Top Free Daily Stock Predictions Dashboard

Daily lists highlighting top overlapping stocks across multiple horizons and model types to help users spot persistent signals.

List of Stocks and Symbols Directory

Quick reference mapping company names to tickers for fast lookup during market sessions.

Investment Guide and Playbooks

A 13-article guide covering basics, strategy comparisons (value vs growth), DCA, dividend investing, options strategies, trade-decision trees, and playbooks for turning AI signals into trades.

Who Can Use This Tool?

- Beginners:Learn investing fundamentals and basic strategies through step-by-step guides and examples.

- Active Traders:Use short- to mid-horizon AI forecasts and daily prediction dashboards to build watchlists and trading ideas.

- Investors:Explore strategy sections like DCA and dividend investing to support longer-term portfolio decisions.

- Researchers:Compare binary vs numeric model outputs and horizon overlaps for exploratory analysis and hypothesis testing.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Free publicly available daily stock predictions (5/10/20-day horizons)

- ✓Both binary and numeric forecast modes, plus confidence labeling for interpretability

- ✓Extensive Investment Guide (13 articles) covering beginner to advanced strategy and signal-to-trade workflows

- ✓Clear disclaimers and policy pages (Terms, Privacy) and transparent contact route (contact page/email)

- ✓Privacy-friendly stance: claims no PII collection through prediction forms and uses anonymous analytics

✗ Cons

- ✗No paid plans, API, or developer/platform integrations found (web-only content)

- ✗Key methodology page appeared missing (404) at time of check — reduces transparency on model internals

- ✗Site content shows formatting/duplication issues in places (readability concerns)

- ✗Reported prediction accuracy is modest (binary accuracies ~53–56% over 5–20 days; numeric errors small but not indicative of guaranteed performance)

- ✗No observable community, reviews, or social proof on the site to validate user experience or adoption