Overview

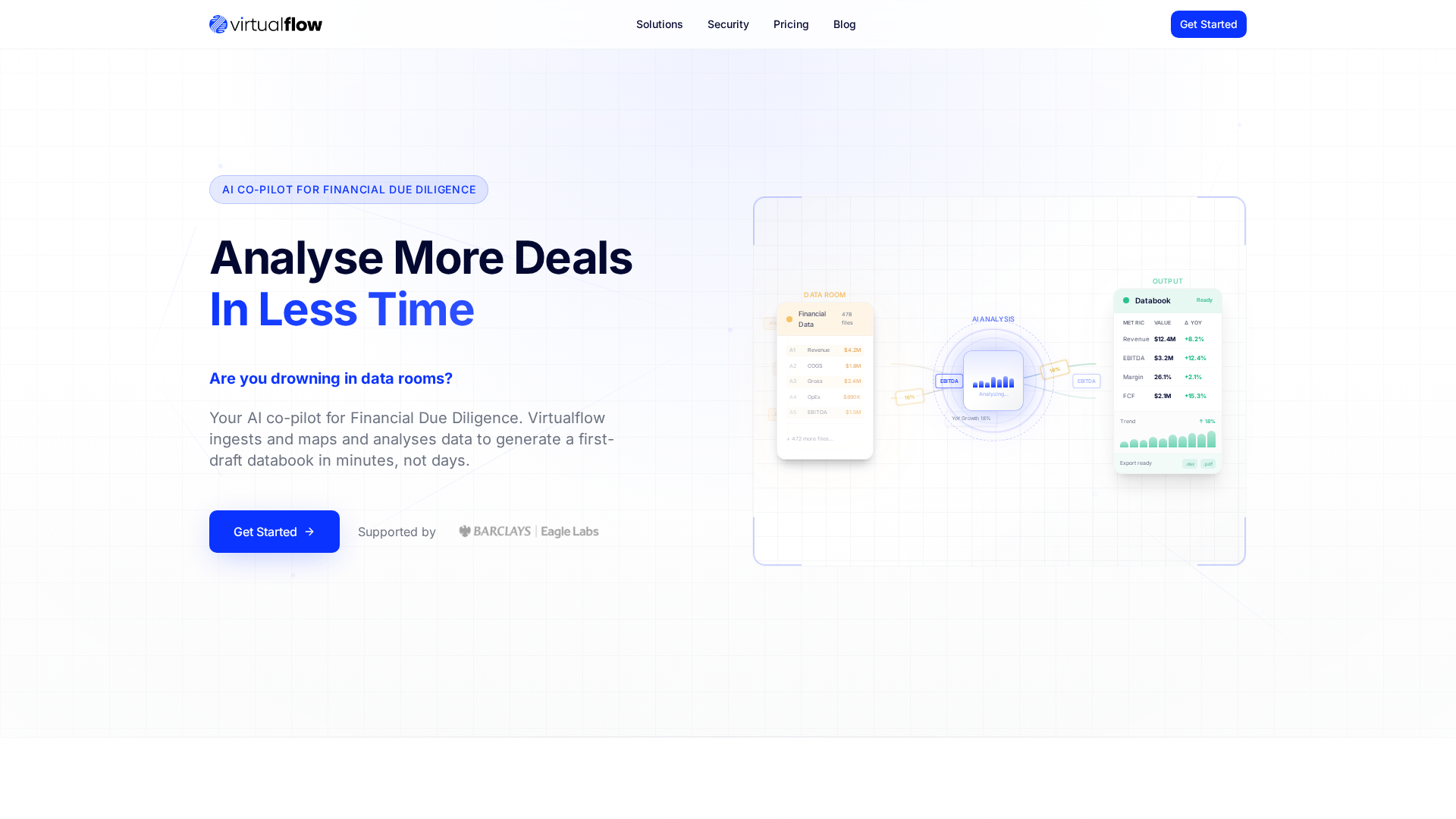

Virtualflow positions an AI Co‑Pilot for financial due diligence that ingests deal materials (financial statements, tax returns, schedules, contracts, and data-room documents) and converts them into structured, auditable insights. The platform emphasizes automated document classification and extraction, normalization and reconciliation of financial data across sources, anomaly detection and risk scoring, and generation of executive summaries, databooks, and variance analyses. Collaboration and governance features (annotations, tasking, evidence trails, access controls) are highlighted to support deal teams and external advisors. Integrations with data rooms and ERP/financial systems, encryption and audit logs are emphasized. Virtualflow is presented as a decision‑support tool that shortens diligence cycles and improves consistency while preserving human oversight and explainability.

Key Features

Automated Document Ingestion and Classification

Reads PDFs, spreadsheets, contracts, and data-room deposits; auto-classifies pages and document types for processing.

Structured Data Extraction and Normalization

Extracts financial-line items, schedules, and disclosures; maps and normalizes figures across multiple source formats to a single schema.

Anomaly Detection and Risk Scoring

Flags unusual variances, related-party items, covenant issues, and other red flags; surfaces prioritized findings and risk scores.

Executive Summaries and Databook Generation

Produces databooks, executive summaries, variance analyses, and auditable outputs rapidly for deal teams.

Traceability and Explainability

Allows drill-down from a finding to the source document and re-creation of calculations for audit and review.

Collaboration, Tasking, and Evidence Tracking

Centralized notes, questions, assignments, and evidence trails with role-based access controls and audit logs.

Who Can Use This Tool?

- Private Equity:Accelerate deal diligence with automated extraction and risk scoring across portfolios.

- Corporate Development:Standardize diligence workstreams and speed integration planning with databooks and summaries.

- Advisory Firms:Reduce manual review time for client engagements and produce auditable deliverables faster.

- Investment Teams:Prioritize findings, quantify risk, and produce consistent investment assessment outputs quickly.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Focused on a high-value, specialized use case: M&A and financial due diligence.

- ✓Automates document extraction, normalization, and audit-ready reporting to save time.

- ✓Emphasizes security, traceability, and integrations with data rooms and financial systems.

- ✓Collaboration features and evidence tracing help with auditability and cross-team workflows.

- ✓Product messaging includes sector templates and customizable risk frameworks.

✗ Cons

- ✗No public, transparent pricing or plans on the website (requires contact/demo).

- ✗Limited publicly available reviews, case studies, or detailed customer references.

- ✗Launch year, team size, and broader adoption metrics not clearly published.

- ✗Some pages returned placeholder/coming-soon content — product may be early-stage or rolling out features.

Related Articles (3)

Learn how AI copilots streamline financial due diligence, speeding insights and reducing risk.

AI-powered co-pilot speeds financial due diligence with automated data handling, risk scoring, and collaborative analytics.

Learn how an AI co-pilot speeds up financial due diligence with automated data processing, risk detection, and collaborative insights.