Overview

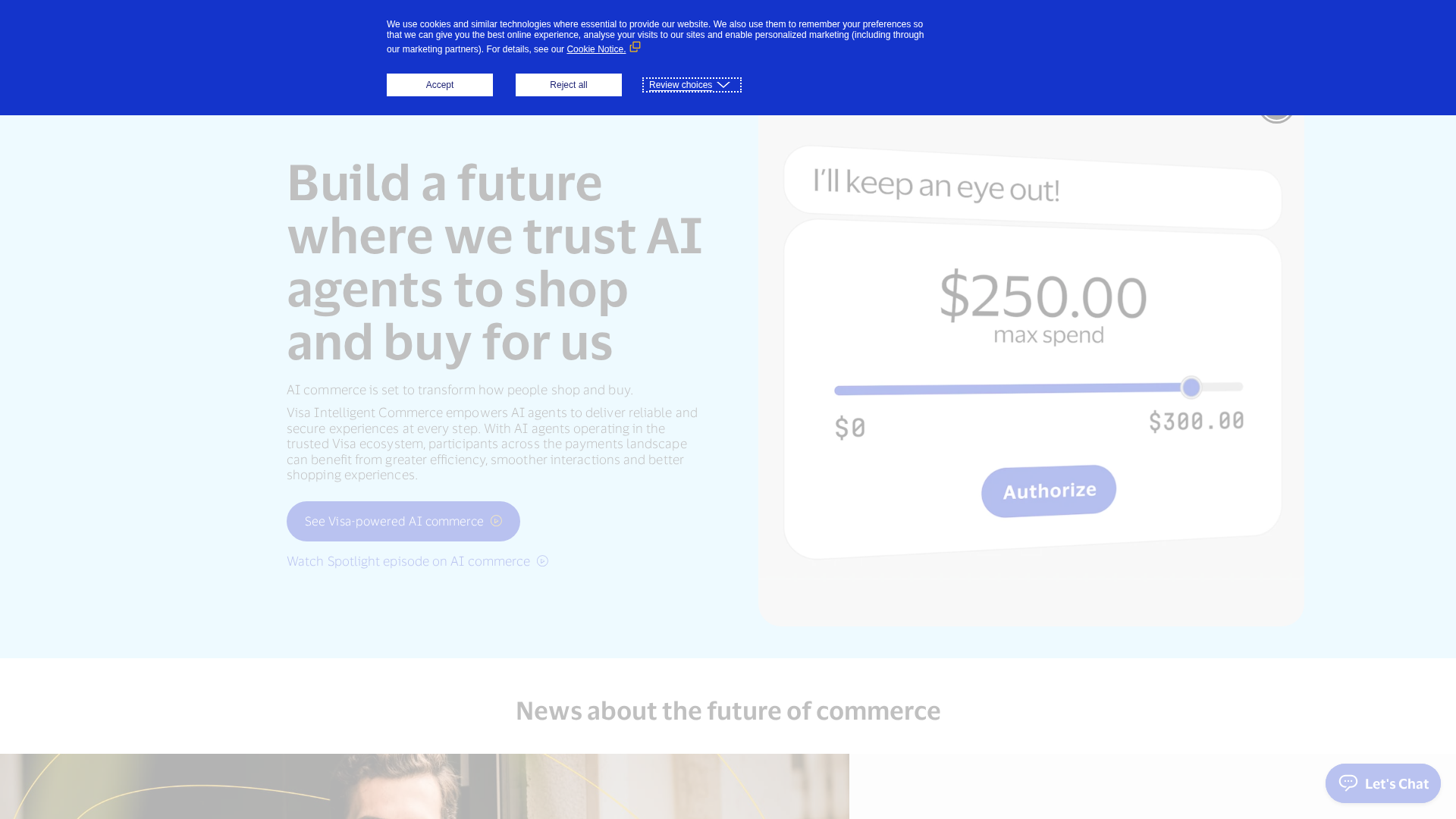

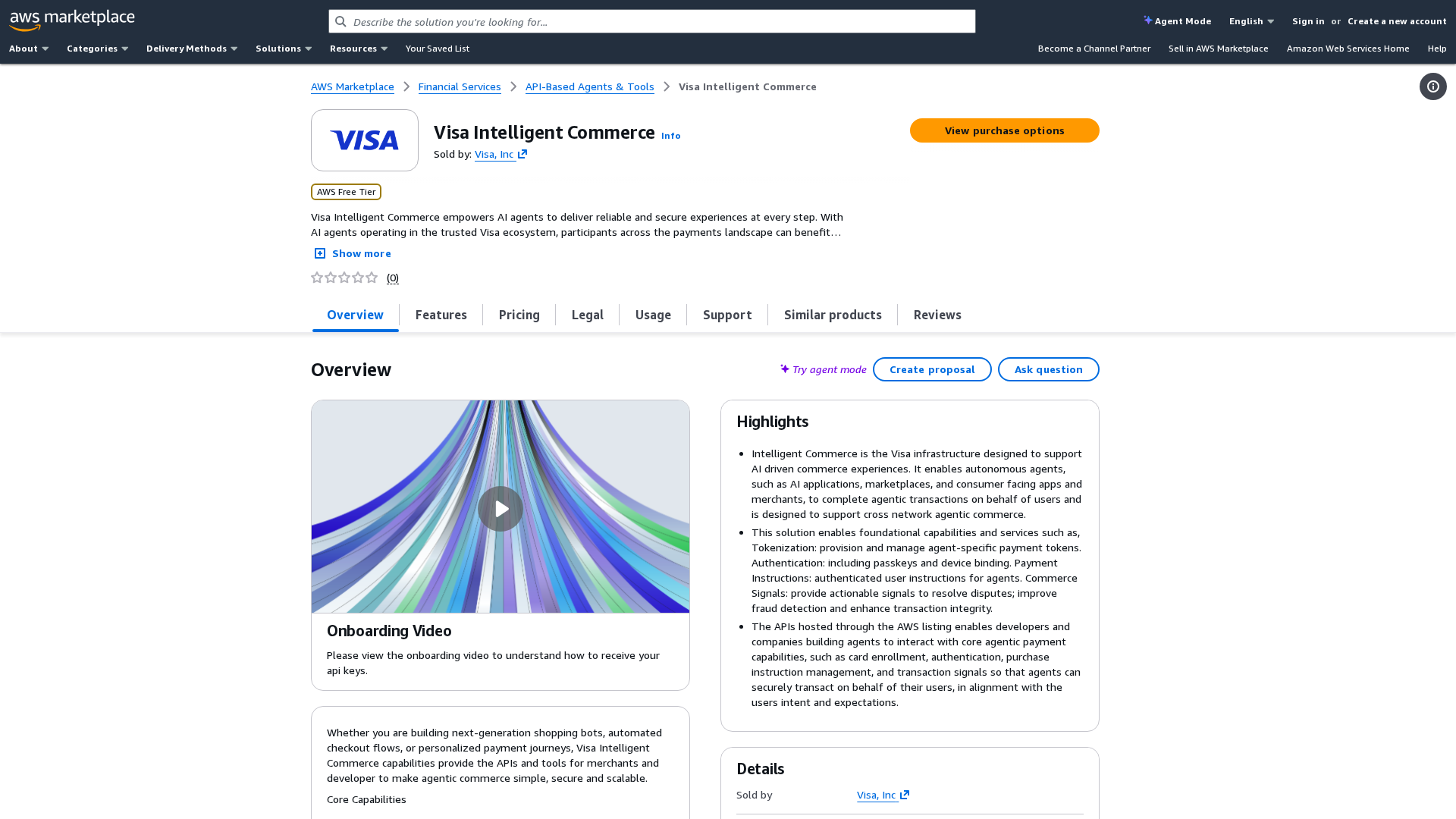

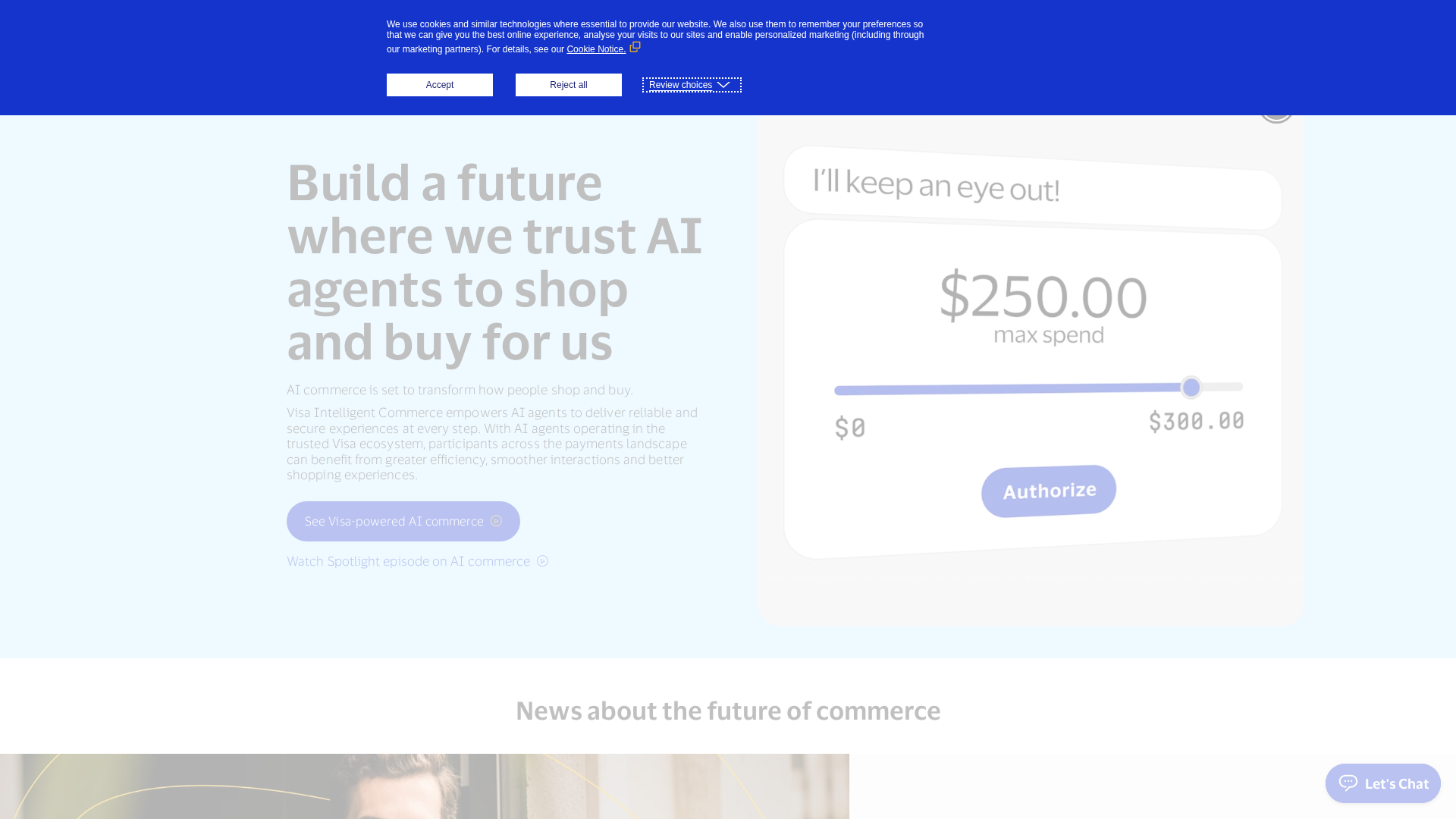

Visa Intelligent Commerce is a payments and commerce platform introduced by Visa in 2025 to enable AI agents to discover, select and purchase goods and services on behalf of consumers while preserving trust, security and consumer control. Built on Visa’s global payments network and decades of fraud/risk management experience, the initiative offers tokenized AI-ready payment credentials, merchant-visible agent signatures (Trusted Agent Protocol), integrated APIs, and developer tooling (MCP Server and Acceptance Agent Toolkit). The platform emphasizes end-to-end protections including configurable spending controls, loyalty/promotion application, and post-purchase dispute support. Visa is piloting the solution with major AI and technology partners and is offering partner programs and restricted developer documentation to authorized integrators.

Key Features

Trusted Agent Protocol

Introduces merchant-visible, purpose-bound, time-limited signatures so merchants can verify trusted AI agents and their intent, reducing merchant friction and fraud risk.

AI-ready Tokenized Payment Credentials

Tokenization and agent-designated credentials ensure only authorized agents can act on a consumer’s behalf, protecting raw card data and enabling secure agent payments.

MCP Server (Model Context Protocol Server)

A secure integration layer that interprets agent requests, manages authentication and dynamically calls Visa Intelligent Commerce APIs to simplify developer implementation.

Acceptance Agent Toolkit

A toolkit (offered as a self-hosted npm package for JavaScript) that provides prebuilt workflows and plain-language triggers for common merchant actions like invoicing and pay-by-link.

AI-Powered Personalization & Spend Signals

Uses consented Visa spend and transaction signals to enable personalized product recommendations, promotions and optimized checkout experiences.

Post-purchase Protections & Dispute Support

Real-time commerce signals and Visa’s dispute resolution capabilities help protect buyers and sellers and manage chargebacks or order issues.

Who Can Use This Tool?

- Developers:Integrate Visa Intelligent Commerce APIs, MCP Server, and toolkits to enable agentic commerce.

- Merchants:Accept trusted agent-driven purchases, reduce cart abandonment, and enforce fulfillment and risk controls.

- Financial Institutions & Platforms:Enable secure agent payment credentials, tokenization and dispute protections for customers and partners.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Built on Visa’s global payments network and fraud/risk infrastructure

- ✓Strong strategic partnerships with major AI and tech companies

- ✓Comprehensive security primitives: tokenization, Trusted Agent Protocol, signatures and agent-scoped credentials

- ✓Developer-oriented tooling (MCP Server) and acceptance agent toolkit to accelerate integrations

- ✓End-to-end considerations: personalization, loyalty integration, programmable spending controls, dispute management

✗ Cons

- ✗Developer documentation is restricted and available only to authorized partners

- ✗No public pricing or self-serve plans; enterprise-only sales model

- ✗Product is early-stage/pilot in many markets — limited wide availability

- ✗Potential regulatory and privacy considerations for agentic commerce across jurisdictions

Related Articles (3)

Visa explains how real-time prompts, tokenization, and proactive controls build trust at the moment of authorization.

FIS teams with Visa and Mastercard to roll out AI-powered agentic commerce for banks, leveraging KYA data and secure transaction capabilities.

Visa Intelligent Commerce enables trusted AI agents to personalize, secure, and streamline buying across a global network.