Overview

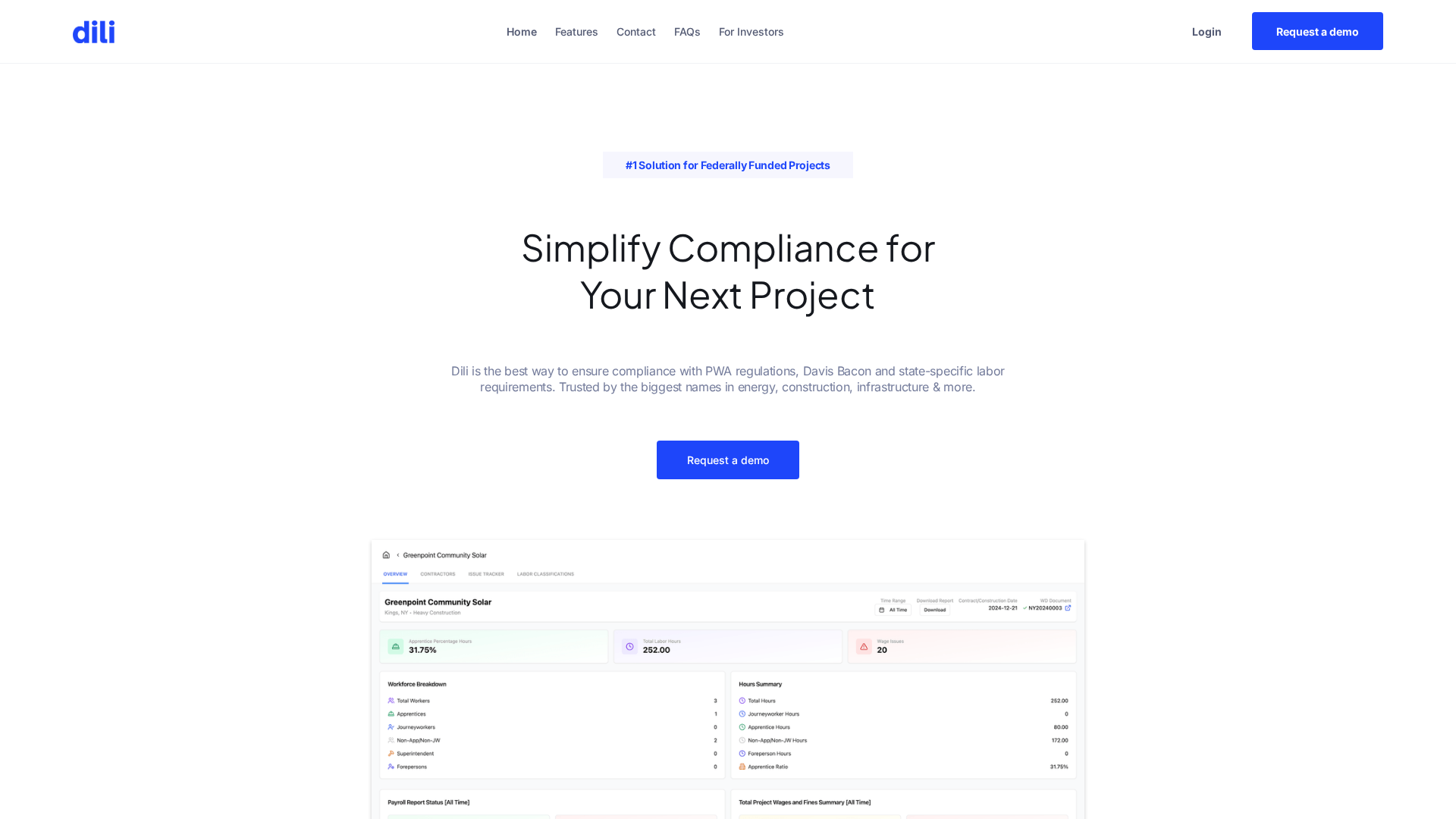

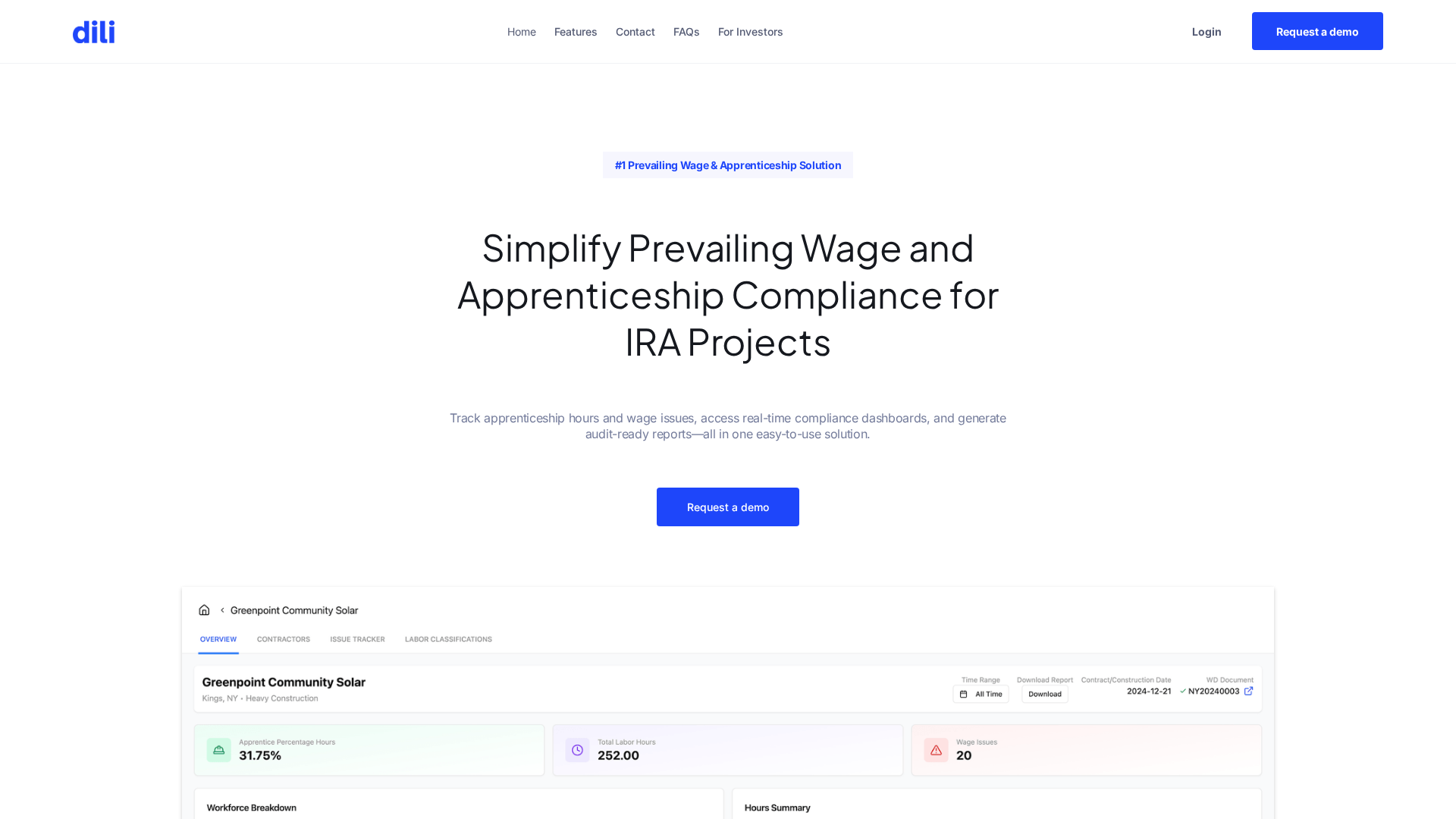

Dili provides a combined software + expert-services platform for Prevailing Wage & Apprenticeship (PWA) compliance (Davis‑Bacon, IRA requirements) and a broader AI diligence product for high‑stakes deals (tax credits, real estate, private equity). Key software capabilities include direct SAM.gov wage‑rate integration (county-level across the U.S.), real-time compliance dashboards (penalties, backpay, apprentice hours), automated apprentice‑hour tracking and wage‑ratio calculations, error detection/pre‑audit checks, and pre-prepared, audit-ready reports. The company also offers a full-service compliance option that acts as an extension of a customer’s team to manage compliance end-to-end. The platform emphasizes integrations with payroll and project management systems, enterprise security practices (SOC 2 referenced on investor pages), and a user-friendly web app with SSO. Public site did not list an explicit launch year or public pricing tiers; procurement is handled via demo/contact requests.

Key Features

SAM.gov Wage-Rate Integration

Automatically retrieves accurate prevailing wage determinations by county for U.S. jurisdictions (direct SAM.gov integration).

Real-Time Compliance Dashboards

Monitor penalties, backpay exposure, apprenticeship hours, and week-over-week progress with dashboards that surface issues early.

Audit-Ready Reporting

Generate pre-prepared, exportable compliance reports for buyers, auditors, IRS, and finance teams on demand.

Apprentice Tracking & Wage Ratio Calculations

Automates tracking of apprentice hours and enforces apprenticeship percentage and wage-ratio requirements.

Error Detection & Pre-Audit Checks

Identifies likely payroll or reporting issues before penalties accrue via automated checks and validations.

Payroll & Project Management Integrations

Connects to payroll systems and project management tools to reduce manual work and errors (integration emphasis noted).

Who Can Use This Tool?

- Contractors:Ensure Prevailing Wage & Apprenticeship compliance for federally funded construction projects.

- Compliance Teams:Automate wage determinations, apprentice tracking, and generate audit-ready reports for audits and finance.

- Tax Credit Advisors / Project Owners:Support IRA/Davis-Bacon compliance to maximize tax credits and reduce audit risk on renewable and infrastructure projects.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Direct SAM.gov integration for accurate wage determinations by county across the U.S.

- ✓Real-time dashboards for penalties, backpay, and apprenticeship hours (helps spot issues early).

- ✓Generates audit-ready, IRS/buyer/auditor-friendly reports on demand.

- ✓Option for full-service compliance management (outsourced expert offering).

- ✓Integrates with payroll and project management tools; enterprise security posture referenced (SOC 2 noted on investor site).

✗ Cons

- ✗No public pricing or self-serve plans — prospective customers must request a demo/contact sales.

- ✗Limited public developer/docs or API documentation surfaced on main site.

- ✗Targeted at enterprise and regulated projects; may be less suitable for very small contractors seeking low-cost self-serve solutions.

- ✗No explicit launch year or detailed product roadmap publicly listed.

Compare with Alternatives

| Feature | Dili | Procurement Sciences AI | StackAI |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.3/10 | 8.2/10 | 8.4/10 |

| PWA Specificity | Yes | No | No |

| Regulatory Integrations | Yes | Partial | Partial |

| Audit-Readiness | Yes | Partial | Partial |

| Automation Depth | End-to-end PWA automation | Proposal and compliance automation | Deep no-code agent automation |

| Workflow Builder | Partial | No | Yes |

| Service Tiers | Yes | Partial | Yes |

| Security Controls | Governance-focused controls | Single-tenant privacy options | Enterprise-grade governance and RBAC |

Related Articles (6)

Contact Us If you're interested in a demo or if you have any questions about PWA compliance, please...

An AI diligence platform that encodes domain knowledge, flags risks, and automates data extraction across high-stakes deals.

Dili’s privacy notice explains data collection, use, sharing, retention, security, and state-specific privacy rights.

Guidance on IRA Prevailing Wage and Apprenticeship compliance for clean energy projects to maximize tax credits.

A comprehensive PWA solution offering real-time wage compliance, apprenticeship tracking, and audit-ready reporting with optional full-service support.