Overview

Vic.ai is an AI-native autonomous finance platform focused on accounts payable (AP) automation. It uses advanced machine learning to extract header and line-item invoice data (no templates), perform PO matching and three-way matching, run Autonomous Approval Flows, and provide analytics and cash flow insights. The platform includes payment functionality (VicPay), a vendor portal, and open APIs for ERP integrations. Vic.ai positions itself for CFOs, controllers, and AP teams at mid-market to enterprise organizations seeking to accelerate invoice processing, reduce manual work, and gain real-time spend visibility. (Summary based on Vic.ai homepage, solutions, FAQ, datasheets, and resources.)

Key Features

Autopilot / No‑touch Invoice Processing

Uses ML confidence thresholds to automatically process invoices without human review when confidence is high, driving no-touch automation and throughput.

Advanced Data Extraction (Header & Line‑item)

Template-free AI extracts structured header and line-item data (including VAT/taxes), enabling accurate GL coding and posting to ERP.

Autonomous PO Matching & Three‑Way Matching

Matches invoice lines to PO and goods receipt data; enables automatic processing of matched invoices and identifies exceptions.

Autonomous Approval Flows

Configurable workflows and approval routing with audit trails to accelerate approvals and maintain controls.

VicPay — Payments & Vendor Portal

Integrated B2B payments (ACH, virtual card, checks, international), vendor portal, payment prioritization, and fraud prevention features.

ERP Integrations & Open API

Public API for syncing master data, posting transactions, and integrating with many ERPs for seamless GL updates.

Who Can Use This Tool?

- CFOs:Accelerate month-end close, improve cash visibility, and optimize working capital decisions.

- Controllers:Reduce AP errors and exceptions while maintaining controls and accurate GL posting.

- AP Managers:Automate invoice processing and approvals to increase throughput and decrease manual work.

- Finance Teams:Free up capacity for analysis by automating data entry and reconciliation tasks.

- Enterprises:Scale AP operations across business units with secure ERP integrations and centralized payments.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓High claimed accuracy (97–99% header-level accuracy; 99% invoice accuracy cited)

- ✓Template-free AI that supports complex, multi-line invoices and scales over time

- ✓Autopilot/no-touch processing that reduces manual effort and increases throughput

- ✓End-to-end capability: invoice ingest → coding → approvals → payments (VicPay)

- ✓Open API and many ERP integrations for real-time GL posting

- ✓Analytics dashboards (Standard, Advanced, Premium) for spend and operational insights

✗ Cons

- ✗No public pricing or transparent self-serve plans; pricing is sales/quote-based

- ✗Enterprise focus may make it less suitable for very small businesses seeking simple, low-cost tools

- ✗Some onboarding/training and optional historical-data training may be required for best results

- ✗Limited publicly-documented UI language support (web UI English, Swedish, Norwegian explicitly noted)

Compare with Alternatives

| Feature | Vic.ai | Magical Agentic AI | Capably |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.0/10 | 8.1/10 | 8.1/10 |

| No-touch Processing | Yes | Partial | Partial |

| Extraction Accuracy | High header and line-item accuracy | Strong unstructured extraction | Accurate extraction with human checkpoints |

| PO Matching | Yes | Partial | Partial |

| Approval Automation | Yes | Partial | Yes |

| Payments Portal | Yes | No | No |

| ERP Integration | Yes | Yes | Yes |

| Agentic Extensibility | Yes | Yes | Yes |

| Governance & Observability | Partial | Yes | Yes |

Related Articles (13)

揭示 YouTube 的工作原理、推荐算法与新功能测试,以及 NFL Sunday Ticket 的最新动态。

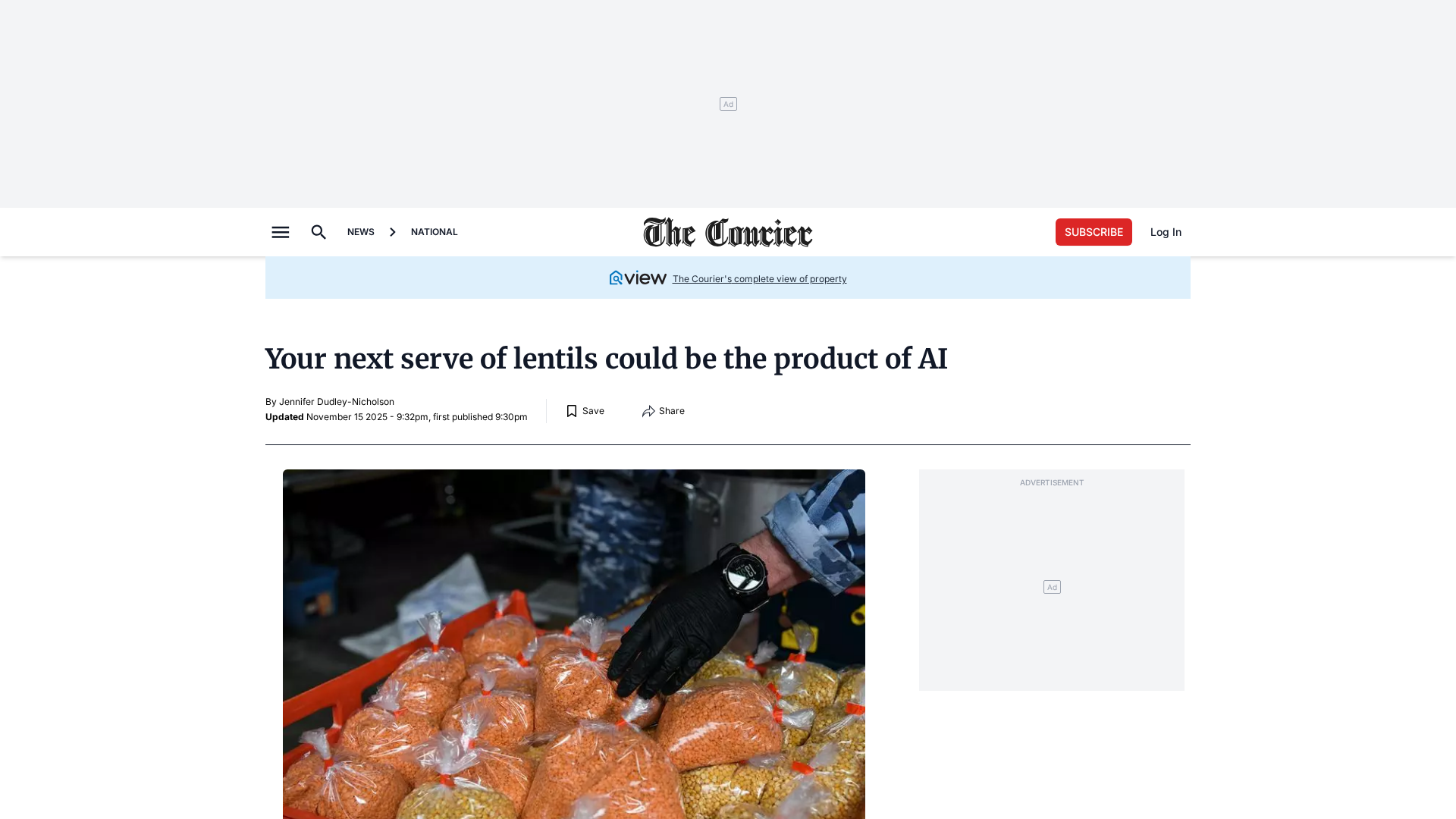

Australian startup Cropify uses AI and hardware to cut lentil grading from 45 minutes to six minutes with its Opal system.

Australian startup Cropify uses AI and hardware to speed up grain grading, starting with red lentils.

Vic.aiのAIファーストAP自動化で請求書処理を自動化・高速化する比較ガイド

Plataforma de automação de contas a pagar com IA de ponta a ponta, incluindo processamento de faturas, correspondência de PO, aprovações e insights.