Overview

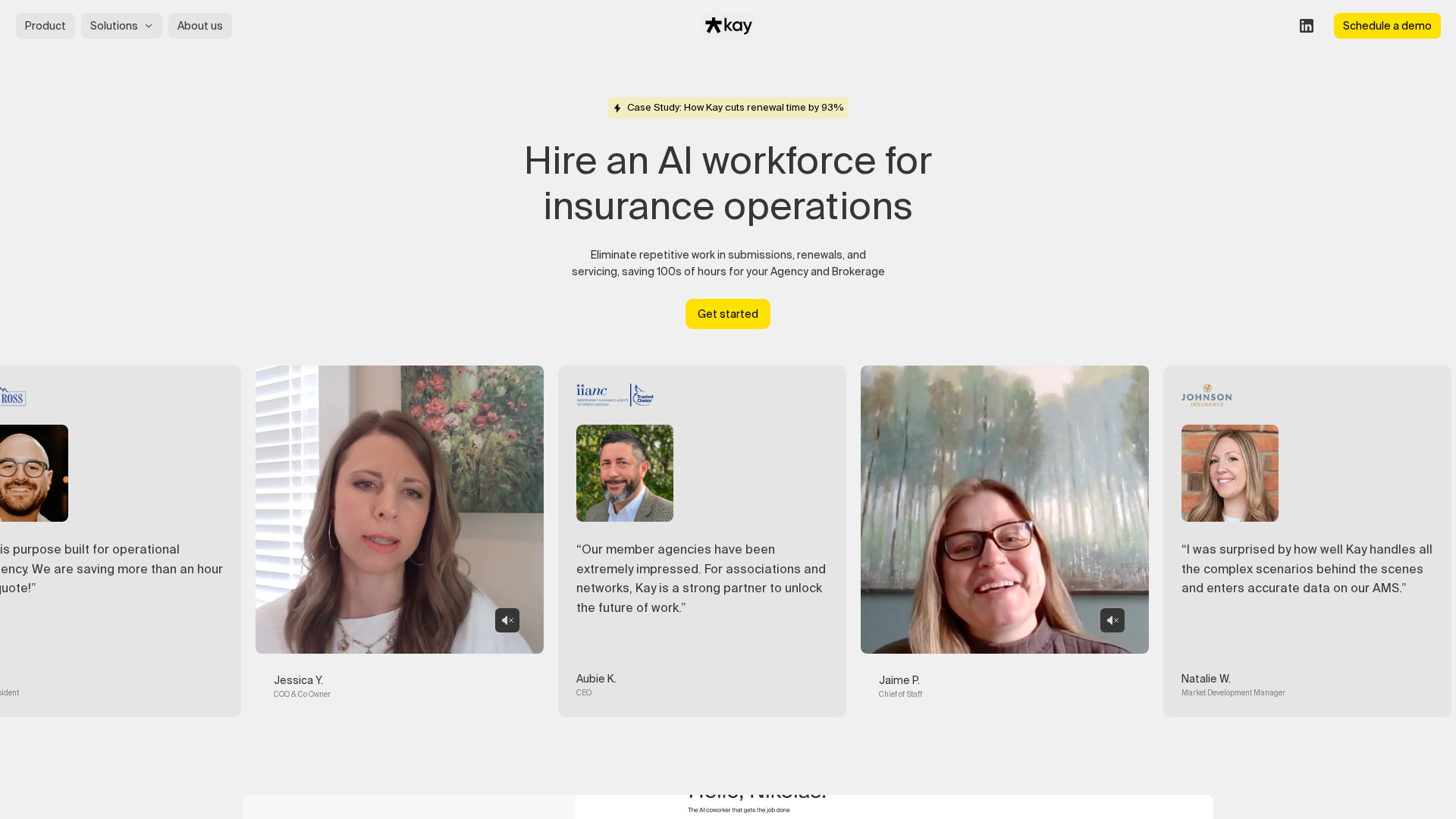

Kay AI (kay.ai) provides a learnable, agentic AI workforce that performs repetitive insurance operations tasks — quoting, renewals, servicing, ACORD and COI generation, AMS/CRM updates, document uploads, and browser-based form entry. Kay learns by demonstration (train once), integrates with an agency’s existing tools and carrier portals, flags uncertainty instead of guessing, and emphasizes accuracy, audit logs and SOC 2–level security. It’s positioned for agencies, brokerages, associations and networks to scale operations without equivalent headcount increases, enabling large time savings and higher throughput. (Summary based on homepage, product, demo, about, and blog pages.)

Key Features

Learn-by-Demonstration Onboarding

Kay observes a demonstrated task, asks preferences, and learns to perform it, enabling faster real-world deployment in days.

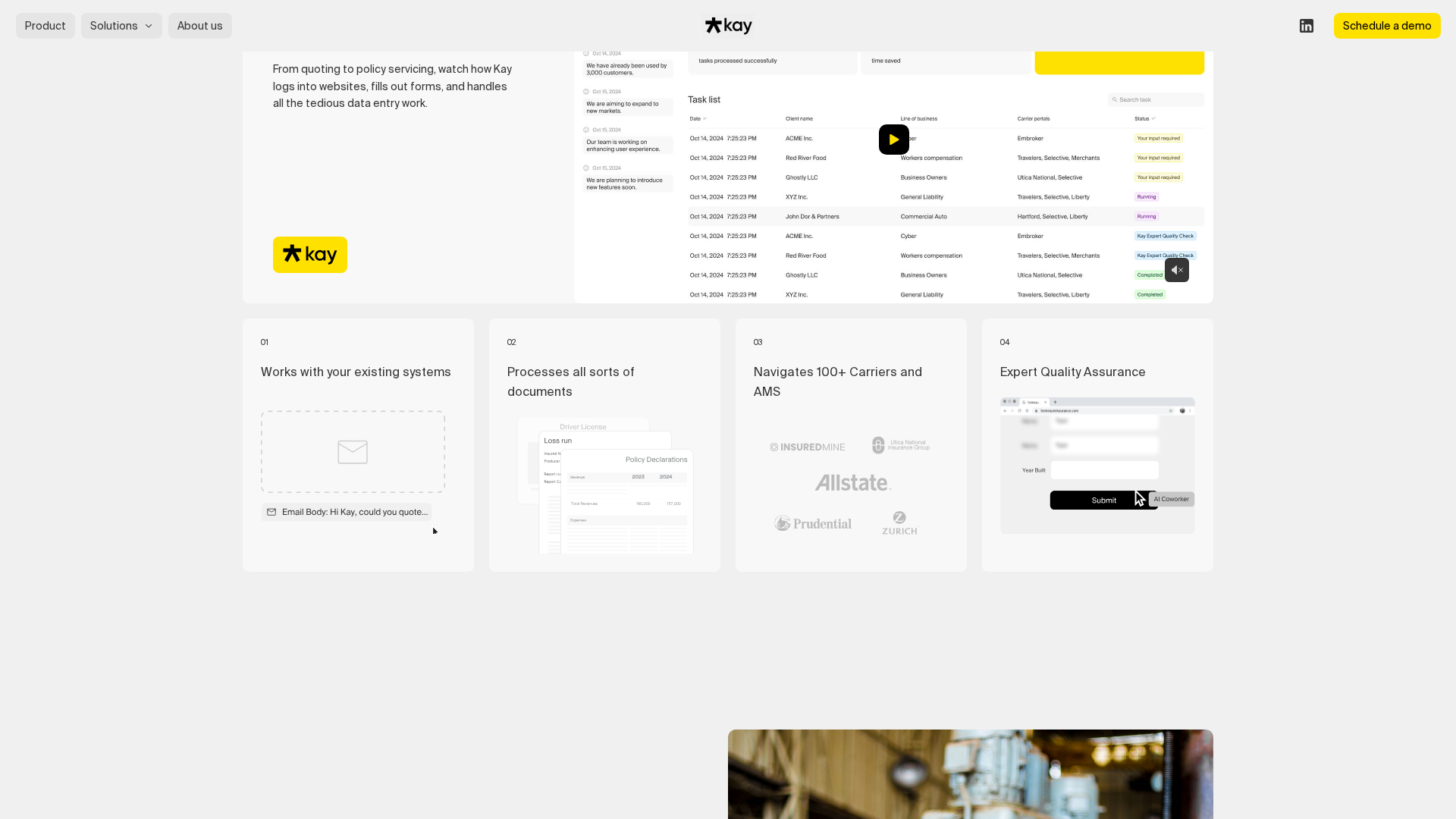

Browser Automation & Portal Interaction

Logs into carrier websites, fills forms, uploads documents, and navigates portal workflows to complete submissions and renewals.

AMS/CRM Integration & Data Entry

Updates Agency Management Systems (AMS) and CRMs, populates policy fields, and keeps records accurate with audit logs.

Quoting & Renewal Automation

Automates quoting across commercial and personal lines, can run reshops and automate entire renewal books.

Document Handling & ACORD/COI Generation

Extracts information from documents, generates ACORDs and COIs, and uploads required carrier paperwork.

Uncertainty Flagging & Human-in-the-Loop

Flags missing or uncertain information instead of making risky guesses; keeps humans in control for edge cases.

Who Can Use This Tool?

- Agencies:Automate quoting, renewals and servicing to save hours per quote and reduce manual work.

- Brokerages:Scale operations and increase quoting throughput without adding headcount.

- Associations/Networks:Offer automation to member agencies and streamline shared workflows and renewals.

Pricing Plans

Pricing information is not available yet.

Pros & Cons

✓ Pros

- ✓Automates a broad set of insurance-specific workflows (quotes, renewals, servicing, ACORDs, COIs).

- ✓Works across carrier websites and AMS/CRMs; can perform browser tasks and fill forms.

- ✓Rapid onboarding model: learn-by-demonstration claims (ready to run in days).

- ✓Emphasis on accuracy — flags uncertainty, detailed action logs, SOC 2 security mentioned.

- ✓Demonstrated customer impact (case study: renewal time cut by 93%).

✗ Cons

- ✗No public pricing or transparent plans — requires demo / contact to get costs.

- ✗Appears focused on insurance vertical only — limited general-purpose marketing.

- ✗Limited public developer documentation or self-serve onboarding materials visible.

- ✗For highly regulated data, some customers may want more detailed compliance disclosures beyond SOC 2 (not publicly detailed).

Compare with Alternatives

| Feature | Kay AI | Simplifai | StackAI |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.4/10 | 8.3/10 | 8.4/10 |

| Onboarding Method | Learn-by-demonstration onboarding | Pre-configured agent templates | No-code low-code workflow onboarding |

| Portal Automation | Yes | Partial | Partial |

| AMS/CRM Integration | Yes | Yes | Yes |

| Quoting & Renewals | Yes | No | Partial |

| Document & ACORD Handling | Yes | Yes | Yes |

| Human-in-Loop Escalation | Yes | Yes | Partial |

| Governance & Security | Yes | Yes | Yes |

Related Articles (30)

This website is using a security service to protect itself from online attacks. The action you just ...

Mary Kay Ash Foundation awards a $50K grant to Baylor Scott & White Health to accelerate cancer research and early detection.

Learn when and how to use kicks instead of punches to improve reach, power, and control in self-defense.

Discover the latest Docebo product updates, features, fixes, and rollout guidance.

An analysis framework for interpreting a single Instagram post when content details are unavailable.