Overview

Simplifai is an enterprise-grade, no-code AI platform focused on insurance and document-heavy workflows. It offers pre-configured AI Agents (e.g., bodily injury, motor, travel) and a DIY platform to build, train, and deploy custom agents. Key platform components include Flow Builder (no-code workflow automation), InsuranceGPT (insurance-specialized large language model), Natural Language Understanding (NLU) and OCR for document/email processing, Human-in-the-loop controls, and integrations with core systems via APIs/RPA. Emphasis is placed on GDPR and ISO/IEC 27001:2022 compliance, secure SDLC, and enterprise-grade scalability to accelerate claims, improve customer service, and reduce operational costs.

Key Features

Flow Builder

No-code orchestration connecting AI modules, apps, and logic to automate workflows and schedule flows.

InsuranceGPT

Insurance-specialized LLM tuned for claims intake, summaries, precedent lookups, and policy-aware suggestions.

Pre-configured AI Agents

Ready-made agents for bodily injury, motor, travel claims, and more — deployable or customizable.

Document & Email Processing (OCR + NLU)

Page-wise classification, extraction, splitting/merging, and routing of multi-page documents and emails.

Human-in-the-Loop

Configurable oversight to handle low-confidence outputs and high-risk decisions with review workflows.

Insights & Analytics

Dashboards showing performance, accuracy, ROI, and workflow metrics to monitor and improve agents.

Who Can Use This Tool?

- Insurers:Automate claims intake, processing, and customer service across high-volume lines.

- Claims Teams:Reduce manual file work and accelerate case resolution with AI-assisted workflows.

- Enterprise IT:Integrate AI Agents into existing systems via API/RPA and maintain compliance controls.

- Consulting/Partners:Co-deliver or resell AI automation solutions and accelerate customer implementations.

Pricing Plans

No public pricing or named plans listed on the website; subscription licenses invoiced annually and consumption-based charges described in terms. Contact sales for pricing and licensing details.

- ✓Enterprise licensing and consumption billing

- ✓Custom integrations and onboarding

- ✓SLAs and compliance agreements negotiated per customer

Pros & Cons

✓ Pros

- ✓Focused, insurance-specific AI (InsuranceGPT, pre-configured agents) reduces time-to-value for insurers.

- ✓Enterprise-grade security & compliance (GDPR, ISO/IEC 27001:2022, SSDLC).

- ✓No-code Flow Builder and DIY agent capabilities enable customization without heavy engineering.

- ✓Human-in-the-loop and audit trails for oversight and risk control.

- ✓Integrations with core insurance systems and API/RPA support.

✗ Cons

- ✗No public pricing or plan details; must contact sales for costs.

- ✗Primary focus on insurance — may be less suitable for non-insurance verticals out-of-the-box.

- ✗Enterprise onboarding and custom integrations likely required for full benefit.

Compare with Alternatives

| Feature | Simplifai | Kay AI | StackAI |

|---|---|---|---|

| Pricing | N/A | N/A | N/A |

| Rating | 8.3/10 | 8.4/10 | 8.4/10 |

| Insurance Specialization | Yes | Yes | No |

| Prebuilt Agents | Yes | Partial | Yes |

| Document Processing | Yes | Yes | Yes |

| Knowledge Retrieval | Partial | Partial | Yes |

| Human-in-Loop | Yes | Yes | Partial |

| Workflow Builder | Yes | Partial | Yes |

| Governance & Observability | Partial | Partial | Yes |

| Deployment Flexibility | Partial | Partial | Yes |

Related Articles (3)

Simplifai appoints Keylane co-founder Ronald Kasteel as chairman of the board to steer growth and governance.

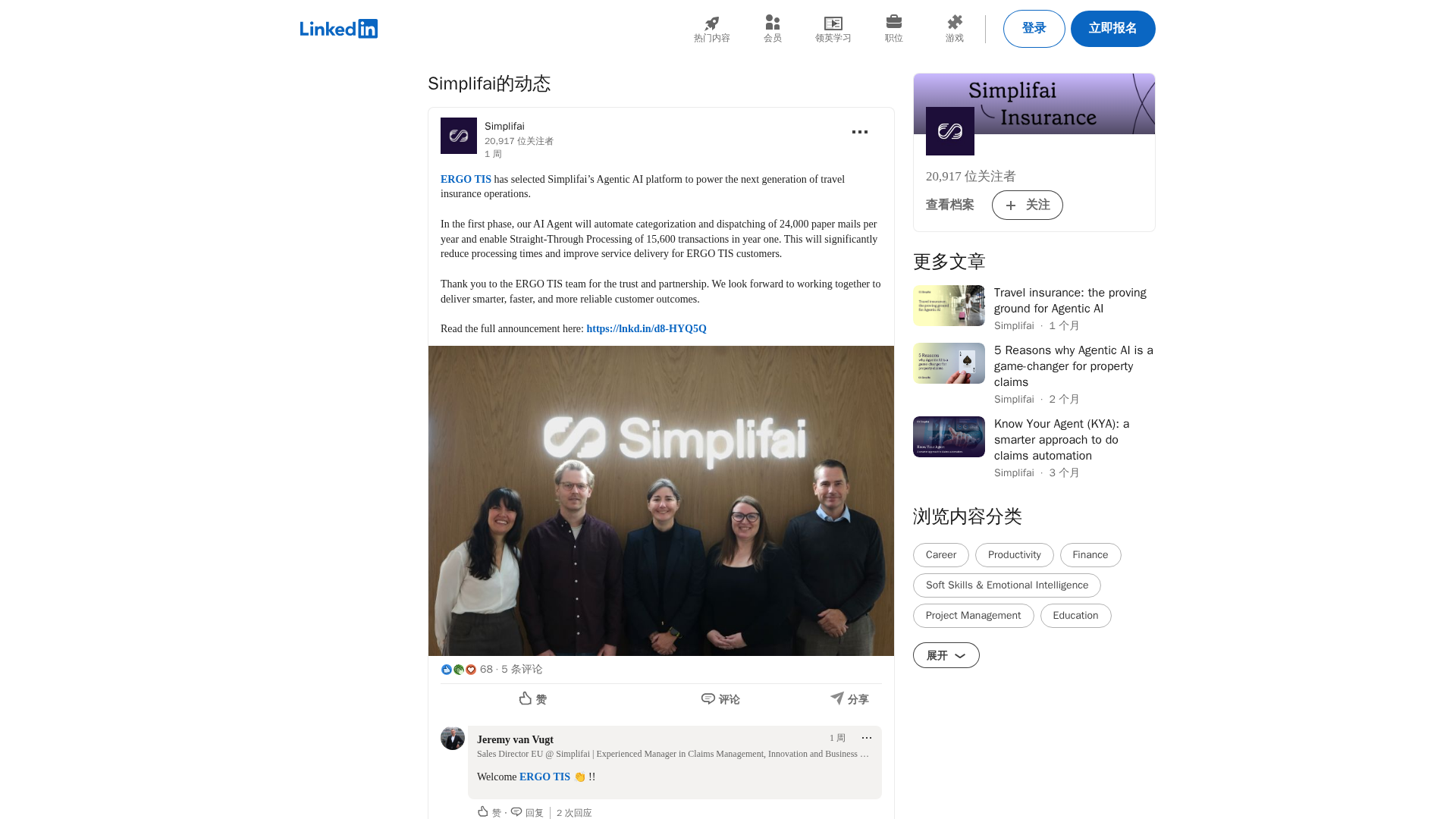

ERGO TIS selects Simplifai's Agentic AI to automate paper mail handling and transaction processing in travel insurance (phase 1).

ERGO TIS selects Simplifai to automate travel claims, accelerating outcomes with AI-driven, end-to-end processing.