Topic Overview

AI-powered financial and trading platforms bring large language models, agent orchestration, and domain-specific analytics into the trade lifecycle—from idea discovery and research to order execution and compliance. This topic covers trading chatbots that let traders query markets and execute strategies conversationally, and market‑intelligence tools that combine embeddings, retrieval-augmented generation, and real‑time feeds to summarize news, surface signals, and prioritize risk. Platforms such as Fulcrum and exchanges like Zoomex exemplify brokerages and trading venues adopting these capabilities; underlying infrastructure comes from enterprise LLM and ML stacks (Vertex AI, Cohere, IBM watsonx Assistant) and agent/automation frameworks (Relevance AI). Relevance and timing: as of 2026, firms are accelerating deployments of private LLMs, multi-agent workflows, and embedded payment/settlement primitives—driven by demand for faster decision-making, cost reduction in research and operations, and new agent-enabled commerce capabilities (e.g., Visa Intelligent Commerce). At the same time, regulated markets increase focus on operational governance: tools like Monitaur and bookkeeping/ document assistants (Bookeeping.ai, ChatPDF) are being used to centralize policy, auditability, model monitoring, and vendor risk management. Key categories and roles: trading chatbots provide natural-language access and trade execution; market intelligence tools synthesize news, filings and alternative data into signals; AI brokerage tools automate execution, order routing and client workflows. A robust stack therefore pairs model platforms (Vertex AI, Cohere, watsonx), agent builders (Relevance AI), governance and monitoring (Monitaur), plus domain connectors for market data and payments. Practical adoption requires balancing latency, explainability, regulatory compliance and model drift mitigation to realize safe, auditable automation in trading environments.

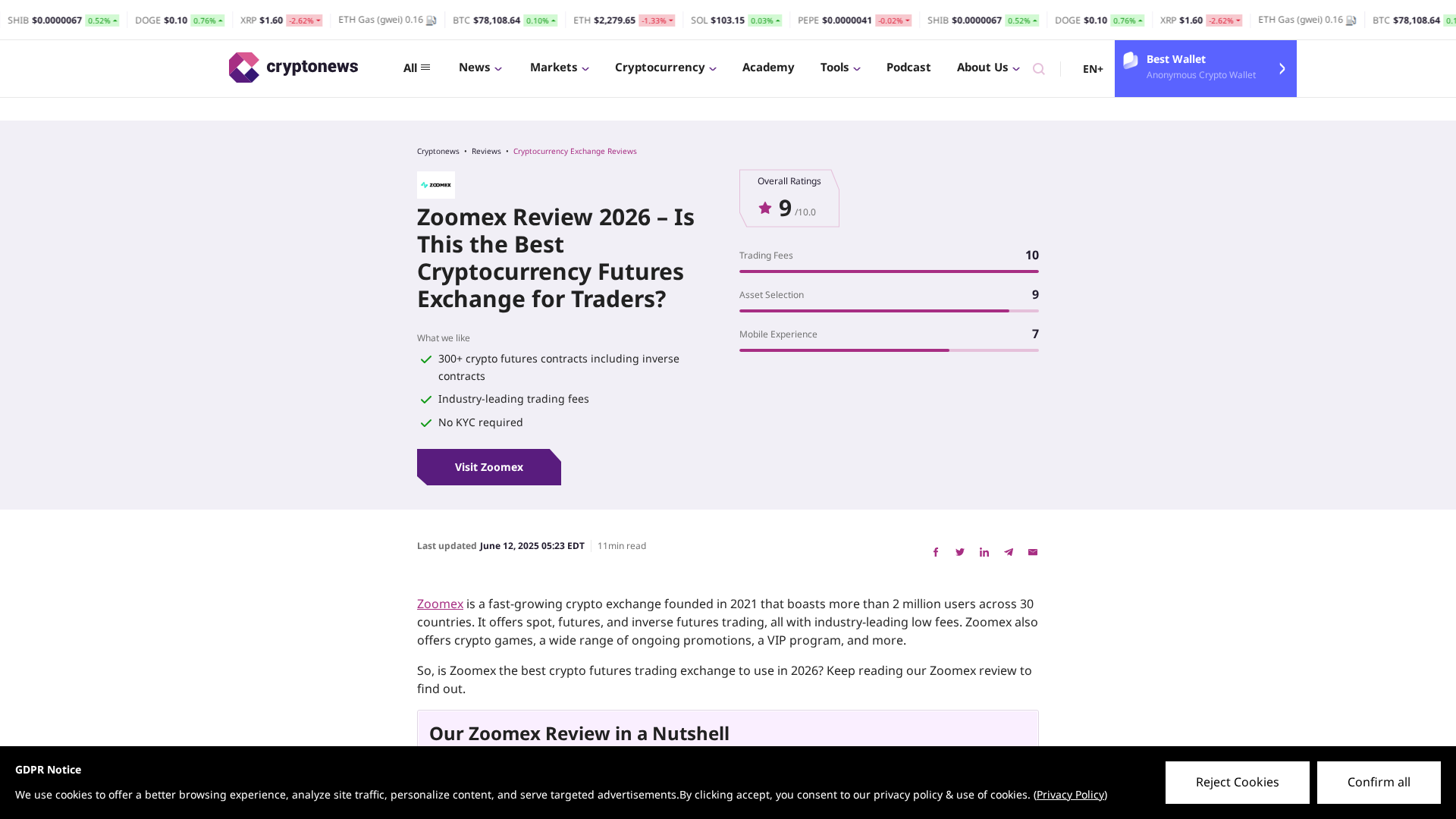

Tool Rankings – Top 6

Unified, fully-managed Google Cloud platform for building, training, deploying, and monitoring ML and GenAI models.

Enterprise virtual agents and AI assistants built with watsonx LLMs for no-code and developer-driven automation.

Insurance-focused enterprise AI governance platform centralizing policy, monitoring, validation, vendor governance and证e

Enterprise-focused LLM platform offering private, customizable models, embeddings, retrieval, and search.

Enabling AI agents to buy securely and seamlessly

Your AI Accountant Paula

Latest Articles (55)

A comprehensive comparison and buying guide to 14 AI governance tools for 2025, with criteria and vendor-specific strengths.

Enterprise page promoting Paula AI Accountant to automate 95% of bookkeeping tasks.

An AI-powered app that auto-categorizes transactions, matches receipts, and provides a financial overview to simplify bookkeeping.

AI-powered, end-to-end bookkeeping with Paula, real-time reports, invoicing, and secure integrations for small businesses.

Profile of the Devi AI-powered team behind Bookeeping.ai, highlighting US roots, awards, and related Visadb.io products.