Topic Overview

This topic surveys AI and blockchain tools aimed at institutional finance and payments: platforms for building and deploying models, agentic automation for operational workflows, governance and compliance frameworks, market‑intelligence capabilities, and post‑quantum‑ready blockchain primitives for payment rails. It is focused on the intersection of model lifecycle management, transaction integrity, and cryptographic resilience that financial institutions require. Relevance as of 2026: regulatory scrutiny of deployed AI, stronger model‑risk and vendor‑governance expectations, and accelerating interest in post‑quantum cryptography for payment infrastructure make these tool categories timely. Institutions must pair scalable model platforms with governance, observability, and vendor controls while preparing settlement and custody systems for future quantum risks. Key tools and categories: Vertex AI and IBM watsonx Assistant represent enterprise model infra and virtual‑agent capabilities for training, deployment, and customer automation. No‑code/low‑code platforms (StackAI, Relevance AI) and agentic infrastructures (Xilos) enable rapid assembly of multi‑agent workflows for reconciliation, trade operations, and payments processing. Monitaur exemplifies AI governance and policy orchestration for regulated firms, centralizing monitoring, validation, and vendor governance. Bookeeping.ai addresses routine accounting and reconciliation automation for back‑office efficiency. Crescendo.ai illustrates customer‑facing AI with human‑in‑the‑loop guarantees useful for dispute resolution and client service. Post‑quantum blockchain tools and standards are treated as a separate but overlapping requirement to future‑proof settlement, custody, and cross‑border rails. Procurement priorities include auditability, explainability, integration with core payment systems, vendor risk controls, and cryptographic standards compliance. Together these tool categories form a practical stack for reducing operational risk, meeting evolving regulation, and improving automation across institutional finance and payments.

Tool Rankings – Top 6

Insurance-focused enterprise AI governance platform centralizing policy, monitoring, validation, vendor governance and证e

Intelligent Agentic AI Infrastructure

Your AI Accountant Paula

Unified, fully-managed Google Cloud platform for building, training, deploying, and monitoring ML and GenAI models.

Enterprise virtual agents and AI assistants built with watsonx LLMs for no-code and developer-driven automation.

End-to-end no-code/low-code enterprise platform for building, deploying, and governing AI agents that automate work onun

Latest Articles (59)

A comprehensive comparison and buying guide to 14 AI governance tools for 2025, with criteria and vendor-specific strengths.

Enterprise page promoting Paula AI Accountant to automate 95% of bookkeeping tasks.

AI-powered, end-to-end bookkeeping with Paula, real-time reports, invoicing, and secure integrations for small businesses.

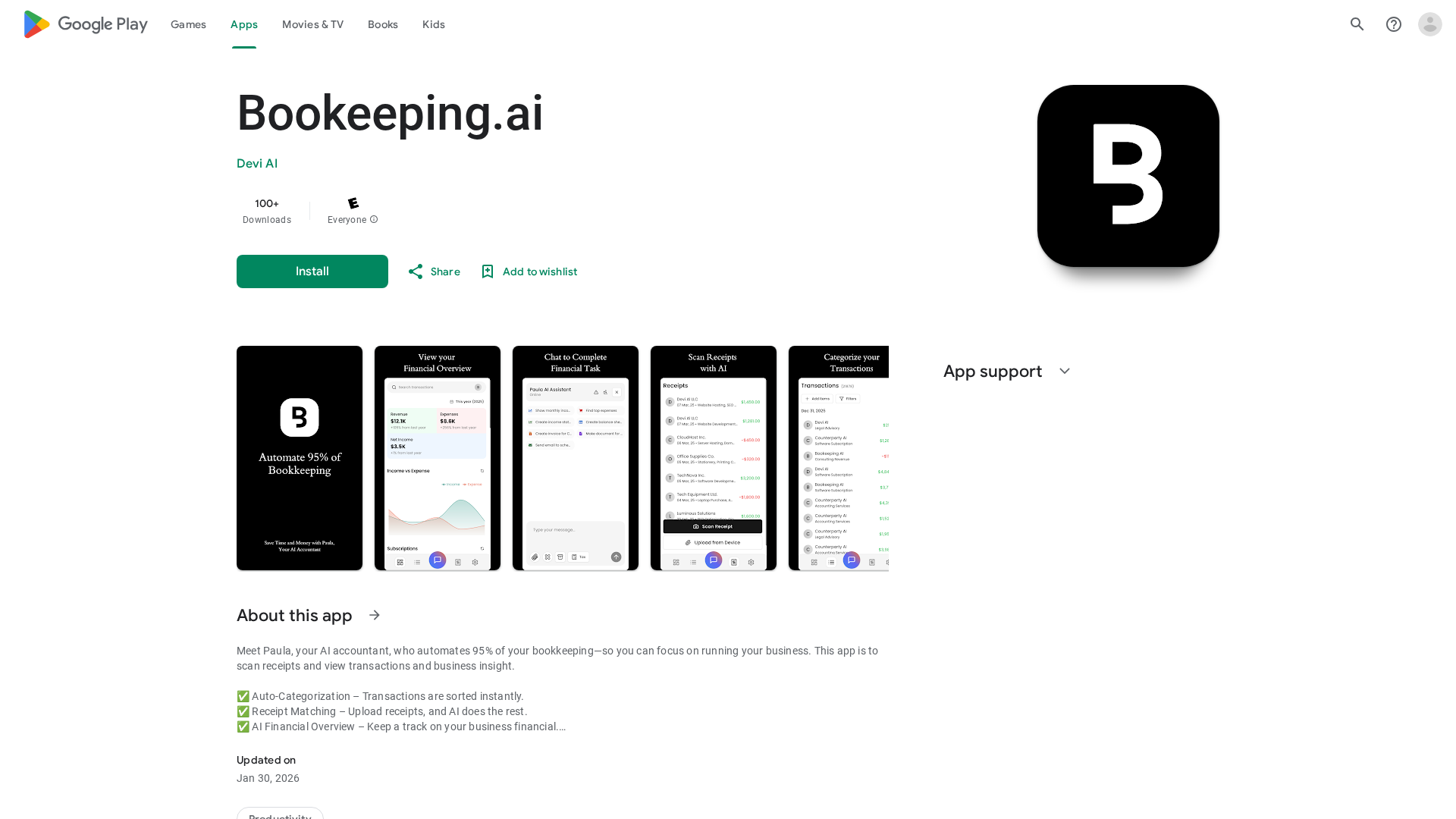

An AI-powered app that auto-categorizes transactions, matches receipts, and provides a financial overview to simplify bookkeeping.

Profile of the Devi AI-powered team behind Bookeeping.ai, highlighting US roots, awards, and related Visadb.io products.