Topic Overview

AI-Driven Crypto Quant & Algorithmic Trading Platforms cover the software stack and tools used to design, backtest, deploy and operate algorithmic strategies for cryptocurrency markets. These platforms fuse high‑throughput market and on‑chain data ingestion (including web scraping and market intelligence), model training and inference, automated agent orchestration, and execution/connectivity to exchanges. As of 2025, broader availability of on‑chain datasets, lower-cost compute, and agentic AI frameworks have made productionizing adaptive quant strategies more accessible — but also increased emphasis on data quality, latency, risk controls and regulatory compliance. Key components and tools: data platforms and web‑scraping layers ingest tick, order-book and on‑chain signals; analytics/BI tools (example: Sisense) provide dashboards, feature-exploration and embedded reporting; agent frameworks and orchestration (LangChain with stateful LangGraph, AutoGPT agents) enable pipelines for signal generation, position sizing and automated monitoring; no‑code/low‑code and developer environments (MindStudio, Replit, Windsurf) accelerate prototyping and deployment; developer SDKs and lifecycle tooling (GPTConsole) manage agent versions, memory and event chaining; coding assistants (Tabnine, GitHub Copilot) speed strategy development; enterprise virtual assistant platforms (IBM watsonx Assistant) help embed governance, access control and operator workflows. Practical considerations include model and data drift, overfitting in backtests, execution latency, slippage, and auditability. The converging trend toward agentic, stateful pipelines and turnkey analytics shortens iteration cycles but raises operational and compliance needs. For teams evaluating Crypto Quant 2026–era platforms, prioritize reproducible backtests, observability for agent decisions, robust data pipelines, and managed risk/execution controls.

Tool Rankings – Top 6

Engineering platform and open-source frameworks to build, test, and deploy reliable AI agents.

Platform to build, deploy and run autonomous AI agents and automation workflows (self-hosted or cloud-hosted).

No-code/low-code visual platform to design, test, deploy, and operate AI agents rapidly, with enterprise controls and a

AI-powered online IDE and platform to build, host, and ship apps quickly.

AI-native IDE and agentic coding platform (Windsurf Editor) with Cascade agents, live previews, and multi-model support.

Developer-focused platform (SDK, API, CLI, web) to create, share and monetize production-ready AI agents.

Latest Articles (68)

A comprehensive comparison and buying guide to 14 AI governance tools for 2025, with criteria and vendor-specific strengths.

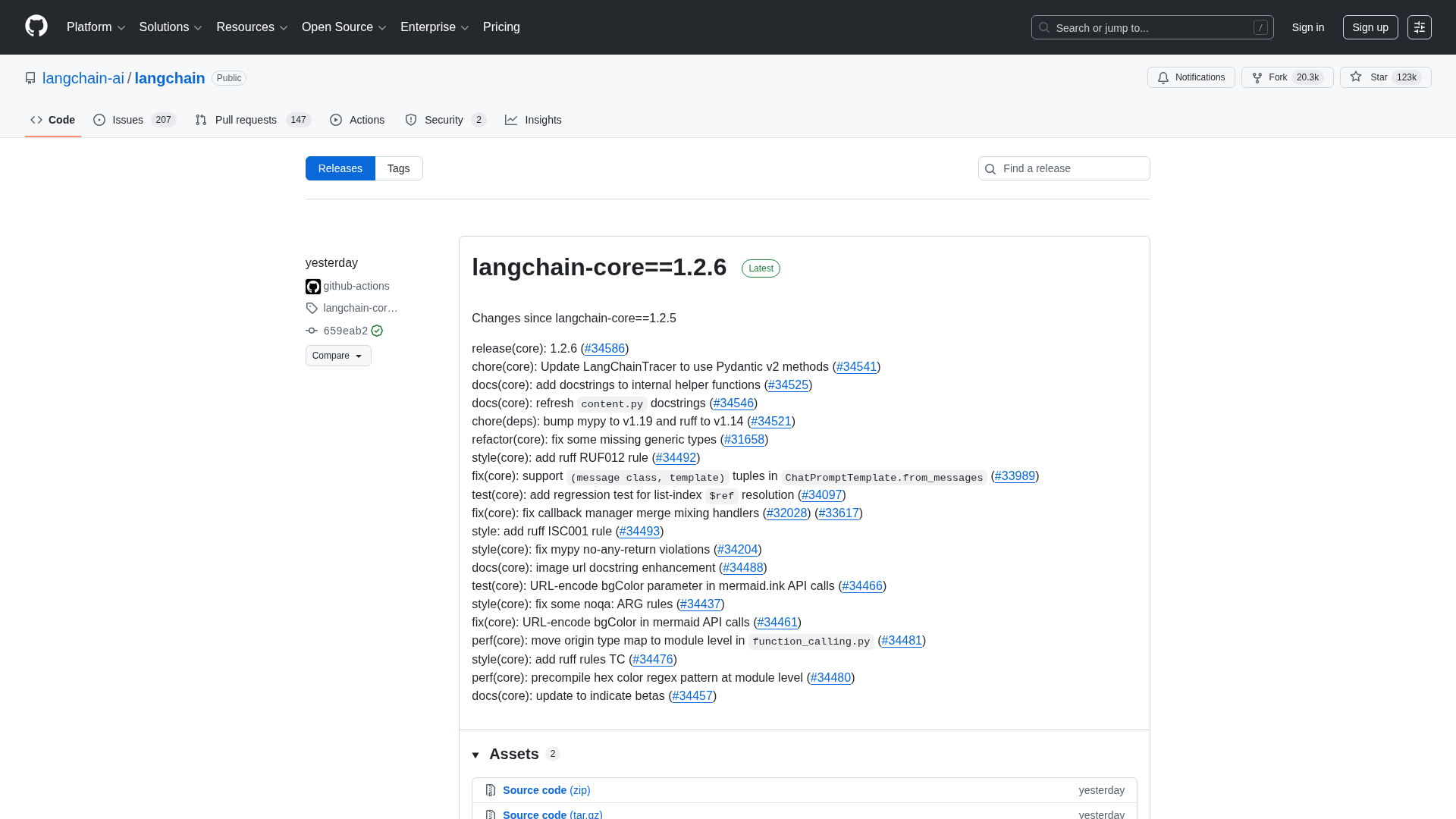

A comprehensive LangChain releases roundup detailing Core 1.2.6 and interconnected updates across XAI, OpenAI, Classic, and tests.

Cannot access the article content due to an access-denied error, preventing summarization.

Adobe nears a $19 billion deal to acquire Semrush, expanding its marketing software capabilities, according to WSJ reports.

Wolters Kluwer expands UpToDate Expert AI with UpToDate Lexidrug to bolster drug information and medication decision support.