Topic Overview

AI-powered crypto trading and portfolio platforms combine large language models, agentic workflows and real‑time market data to automate strategy generation, execution, and portfolio monitoring. As of 2025-12-22, providers from consumer exchanges to institutional funds (examples include CoinJar AI, recent Gate app upgrades, and CoinFund research) illustrate a shift toward embedded AI features: narrative research, automated backtesting, trade recommendation engines, and explainable P&L attribution. This makes the category relevant amid higher market complexity, regulatory scrutiny, and demand for faster, data-driven decisions. Key tool categories that enable these platforms include Market Intelligence Tools (real‑time price, on‑chain, and sentiment feeds), Competitive Intelligence Tools (peer performance benchmarking and feature-differentiation), and AI Data Platforms (model hosting, data pipelines, and governance). Developer tooling matters: LangChain and similar frameworks provide the agentic scaffolding for building, testing, and deploying LLM agents that can maintain state and orchestrate multi-step trading workflows; AI-native IDEs like Windsurf (formerly Codeium), Replit, and assistants such as GitHub Copilot or Tabnine accelerate development, prototyping and secure, context-aware code delivery; Perplexity‑style answer engines help surface cited research and on-demand market explanations. Practical trends to watch are tighter model governance, private or on‑prem model deployments for custody-sensitive workloads, tighter integration of on‑chain analytics with traditional market data, and improved explainability for compliance and risk teams. Together, these capabilities position AI-powered platforms to reduce manual research overhead, speed iteration on strategies, and provide auditable insights — while raising new operational and regulatory considerations for firms and individual traders alike.

Tool Rankings – Top 6

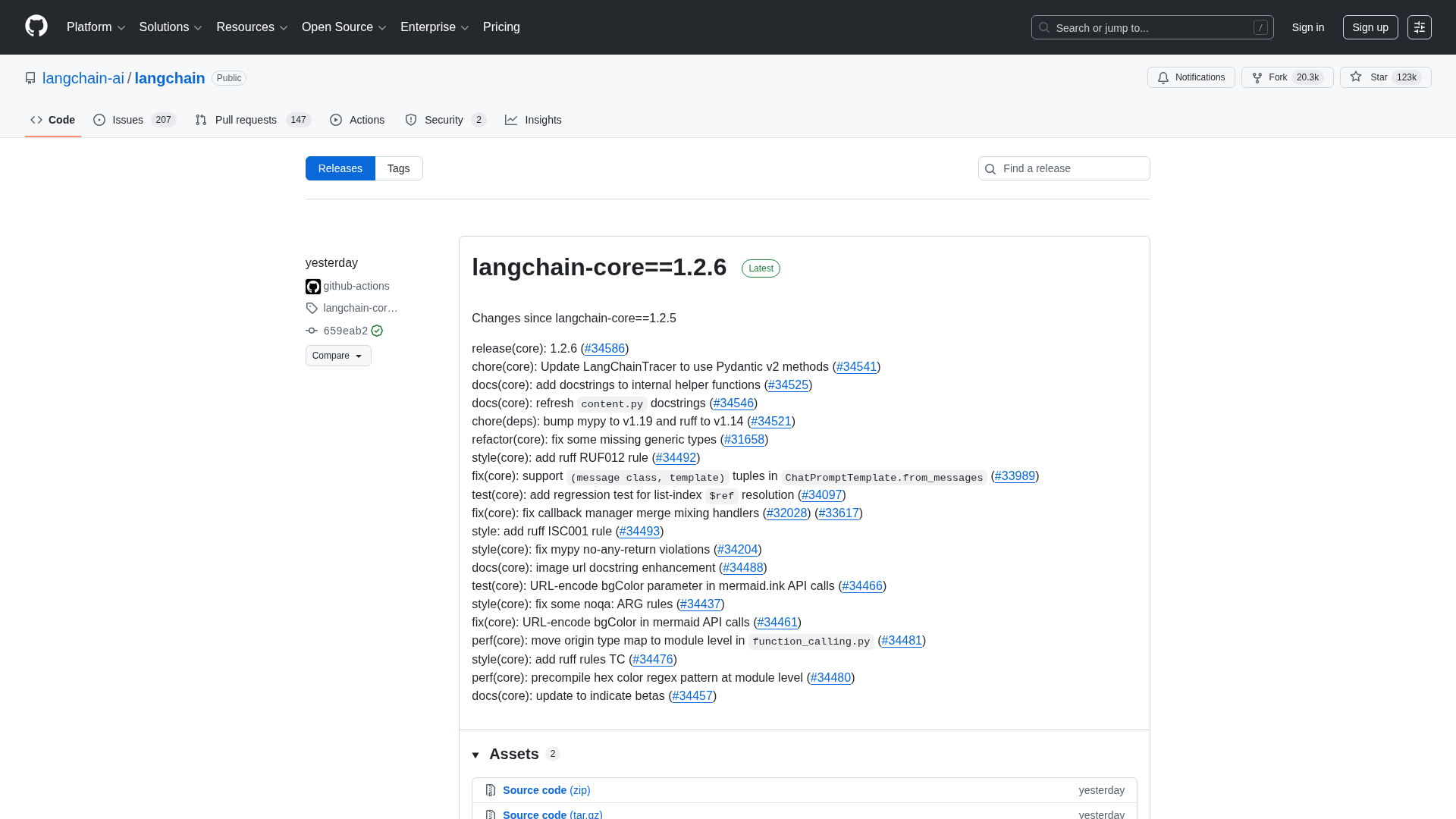

Engineering platform and open-source frameworks to build, test, and deploy reliable AI agents.

AI-native IDE and agentic coding platform (Windsurf Editor) with Cascade agents, live previews, and multi-model support.

AI-powered online IDE and platform to build, host, and ship apps quickly.

An AI pair programmer that gives code completions, chat help, and autonomous agent workflows across editors, theterminal

Enterprise-focused AI coding assistant emphasizing private/self-hosted deployments, governance, and context-aware code.

AI-powered answer engine delivering real-time, sourced answers and developer APIs.

Latest Articles (43)

A comprehensive LangChain releases roundup detailing Core 1.2.6 and interconnected updates across XAI, OpenAI, Classic, and tests.

Cannot access the article content due to an access-denied error, preventing summarization.

A quick preview of POE-POE's pros and cons as seen in G2 reviews.

Get daily, curated trending ML papers delivered straight to your inbox.

Dell unveils 20+ advancements to its AI Factory at SC25, boosting automation, GPU-dense hardware, storage and services for faster, safer enterprise AI.