Topic Overview

This topic covers the evolving ecosystem of AI-driven crypto and quantitative trading platforms aimed at institutional and professional users. It focuses on how agent frameworks, autonomous workflows, and AI-native developer tools are being combined with market‑intelligence and data analytics stacks to build, test, and deploy trading strategies that use on‑chain and alternative data. Relevance in late 2025–early 2026 is driven by increasing institutional adoption of crypto markets, tighter regulatory scrutiny, and demand for reproducible, explainable model pipelines and operational governance. Key tool categories include AI Data Platforms (vector stores, RAG/stateful orchestration and data connectors), Market Intelligence Tools (real‑time signal and alternative‑data feeds), and Data Analytics Tools (backtesting, risk analytics, and model explainability). Representative building blocks from the developer and agent ecosystem include LangChain (engineering frameworks and LangGraph for stateful LLM applications), AutoGPT and AgentGPT (autonomous agent/workflow builders for automation and continuous strategy monitoring), and AI-native IDEs like Windsurf, Warp, and Replit that accelerate development, testing, and deployment. Open/self‑hosted assistants such as Tabby and enterprise-focused helpers like Tabnine and GitHub Copilot help teams maintain private model contexts and governance, while Microsoft 365 Copilot supports cross‑team research and documentation. Practically, modern quant/crypto stacks pair high‑quality, low‑latency market feeds with agentic orchestration for data collection, hypothesis testing, and automated execution; they emphasize traceability, model risk controls, and deployment options (cloud or self‑hosted). The result is a modular, developer‑centric toolchain that prioritizes reproducible analytics, faster iteration, and operational controls essential for institutional trading in 2026.

Tool Rankings – Top 6

Engineering platform and open-source frameworks to build, test, and deploy reliable AI agents.

Platform to build, deploy and run autonomous AI agents and automation workflows (self-hosted or cloud-hosted).

A browser-based platform to create and deploy autonomous AI agents with simple goals.

AI-native IDE and agentic coding platform (Windsurf Editor) with Cascade agents, live previews, and multi-model support.

Agentic Development Environment (ADE) — a modern terminal + IDE with built-in AI agents to accelerate developer flows.

AI-powered online IDE and platform to build, host, and ship apps quickly.

Latest Articles (78)

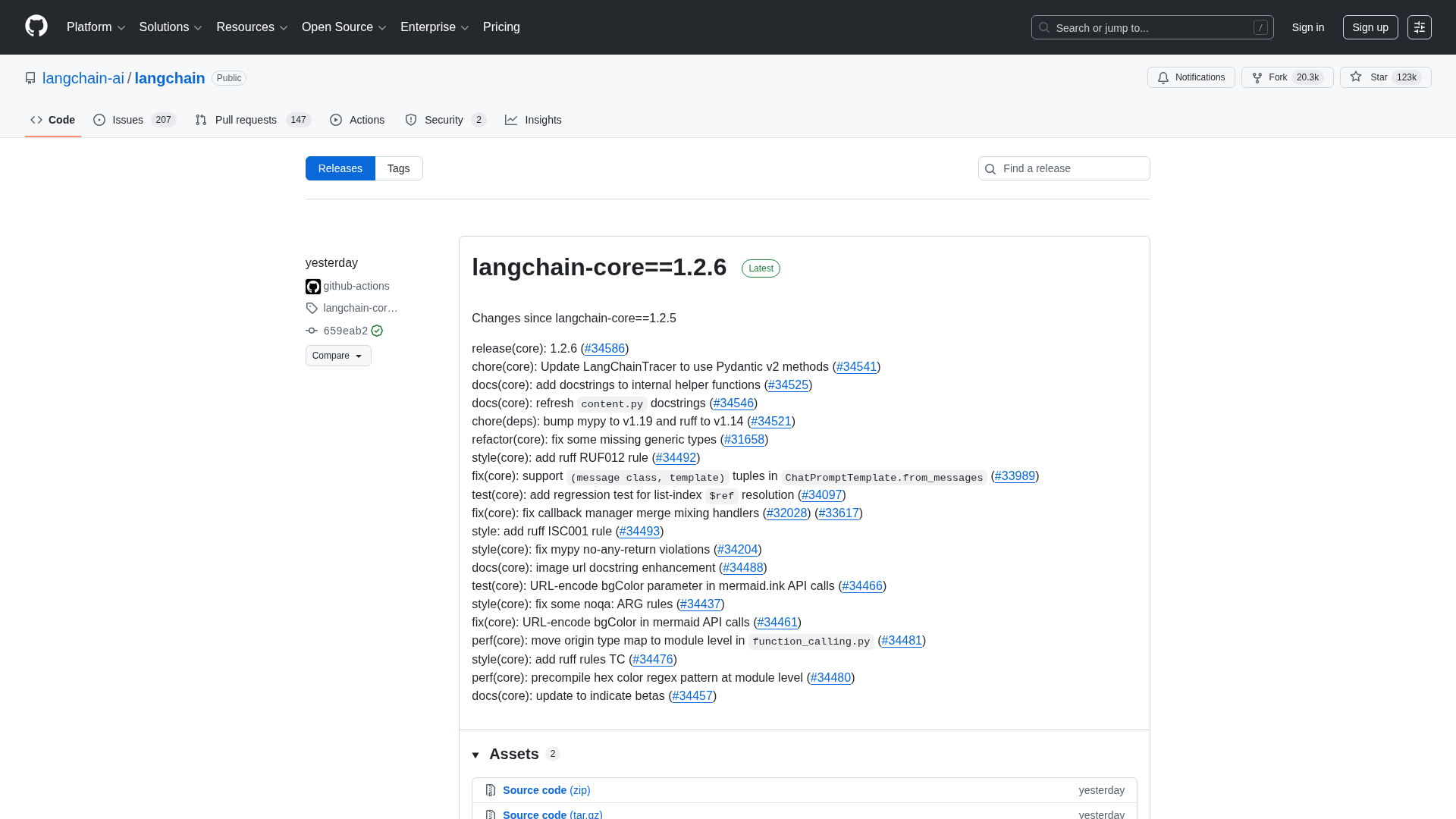

A comprehensive LangChain releases roundup detailing Core 1.2.6 and interconnected updates across XAI, OpenAI, Classic, and tests.

Cannot access the article content due to an access-denied error, preventing summarization.

A quick preview of POE-POE's pros and cons as seen in G2 reviews.

Meta and Sify plan a 500 MW hyperscale data center in Visakhapatnam with the Waterworth subsea cable landing.